NEW YORK—Shareholders of Citigroup Inc. rejected a proposed pay package for Chief Executive Officer Vikram Pandit at its annual meeting this week. This is the first time shareholders of a Wall Street bank have rejected executive compensation.

Citigroup Shareholders Reject Executive Pay Package

The vote sent a powerful message to the board of one of the country’s biggest banking firms.

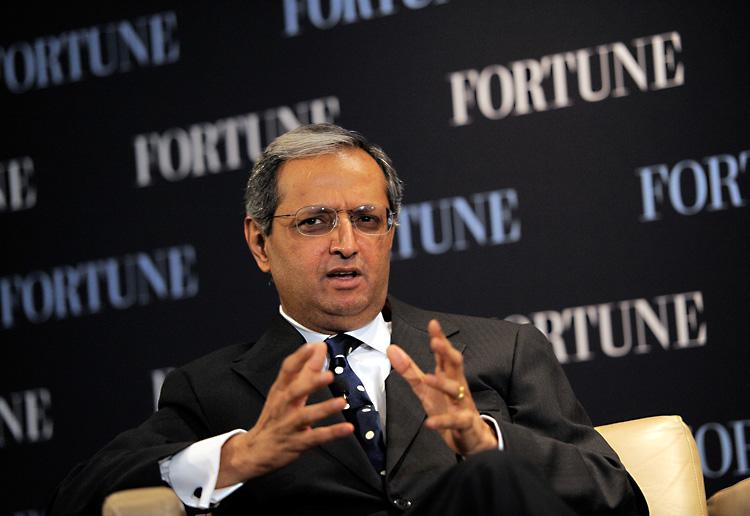

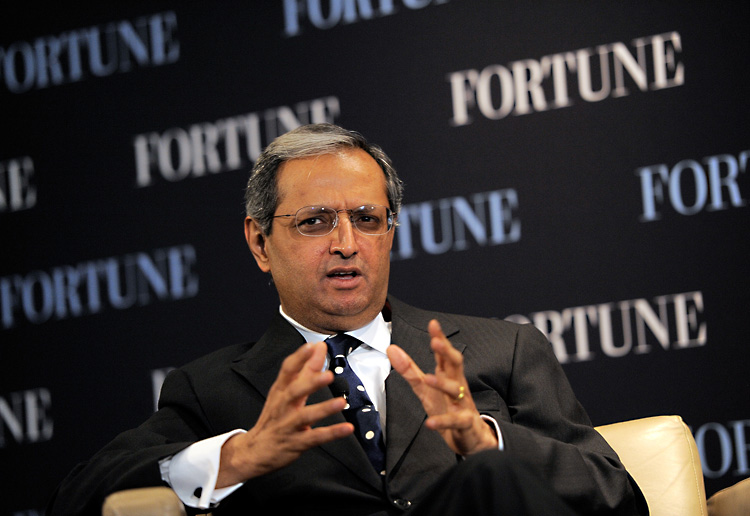

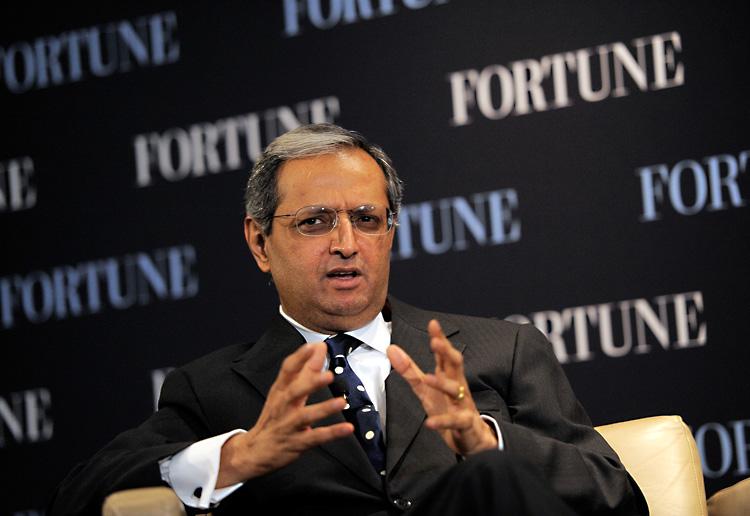

CEO of Citigroup Vikram Pandit speaks during the FORTUNE Breakfast & Conversation with Vikram Pandit, at TIME Building on October 12, 2011 in New York City. Jemal Countess/Getty Images

|Updated: