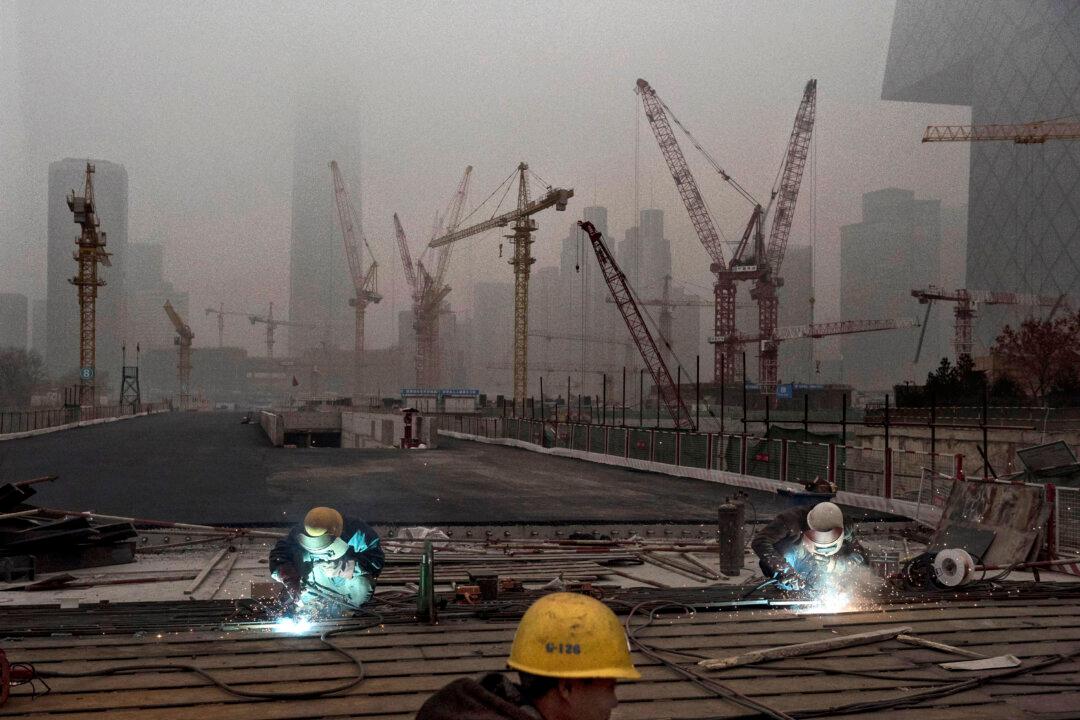

What an astronomical figure! 42 trillion yuan, that’s 42 thousand billion yuan, or 6.9 trillion US dollars. These giant mounds of money have been wasted over the past 5 years in China—in airports, industrial zones, and highways that no one needs.

The staggering number comes from an article published in Shanghai’s stock market newspaper on Nov. 20. Two doctors in economics who are close with the government admitted that half of China’s miraculous growth arose from irrational investment madness and mismanagement. Xu Ce and Wang Yuan work for the “State Commission for Development and Reform”—a committee that reports to the central government, and directly controls China’s economics and social development policies.

It is even more surreal that such dramatic research data was published at all: under the motto “we need to improve a few minor details”, the information was released in a long and boring academic article, intertwined with the usual praise.

Bad Investments Keep Accumulating

“Investments with trivial or zero return have become a serious issue that the government must deal with,” Xu and Wang wrote.

From 2009 to 2013, between 4.7 and 13.2 trillion yuan were wasted, for a total of 42 trillion yuan (US$ 6.9 trillion) over a five years period. Bad investments reached their peak in 2013, where they made up 47 percent of China’s gross investment.

The problem is that China’s economic growth is completely dependent on investment, and most of the money goes to fixed assets. From January to September 2014 alone, 42 percent of China’s GDP growth came from investments. Xu and Wang found that the growth rate in fixed assets was even higher than the percentage of GDP growth since 2000.

Adventurous Developments After 2008

Although Wang and Xu don’t go so far as to say that the communist system of planned economy, with its artificial growth targets, is a major cause for the misery, they did notice some political and systemic reasons. They blamed, for instance, the easing measures, which China adopted after the 2008 financial crisis, for the careless handling of the money.

A systemic cause can also be found in the fact that capital raising became easier after 2008 (China’s gigantic shadow banking system did not develop until after 2008 as well). Both researchers suggested to no longer count the performance of local governments in the future GDP growth, and to adopt more stringent requirements for basic administration, so that local governments can no longer sell off land as they please.

This Is How Bad Investments Work

Yearly, Beijing issues investment targets to local governments, which they need to achieve one way or another. And this leads to money being badly spent. As the Chinese economy supervisory body examined the investment decisions made by 18 state-owned enterprises in 2010, it found that, out of 625 decisions taken, approximately one in four was bad (164 decisions!)—leading to a total investment loss of 3.4 billion yuan.

Wang and Xu, too, named a few typical cases where investments “don’t contain any potential for production”:

- When constructing new factories, no profitable operation is possible in the end, because the wrong machinery was procured, so production becomes impossible. Or, the delivered goods don’t meet the quality standards; or the quality standards can’t be controlled, so the product can’t be brought to market.

- All the above criteria are met, but the product can’t be brought to market due to overcapacity, because too many factories are offering the same products—leading to a meaningless investment just the same. (A sample survey of Chinese companies showed that in 2013 the utilisation of the plants is on average only 72 percent. In the manufacturing and engineering industry merely 70.8 percent of the assets is being used.)

- “Premature investments” are purchases that turn out to be pointless because they are lying around unused, like trains and locations without rails. Lack of cooperation between provincial governments, for instance, leads to four-lane highways connecting to 10-lane highways at the provincial borders.

- Waste during the investment process, such as bad planning and the resulting excess purchases of materials.

Recently, the renowned Chinese crash predictor Niu Dao called China’s real estate bubble the “biggest bubble in world economic history”, and predicted that future rate hikes by the Fed will cause it to collapse in waves.