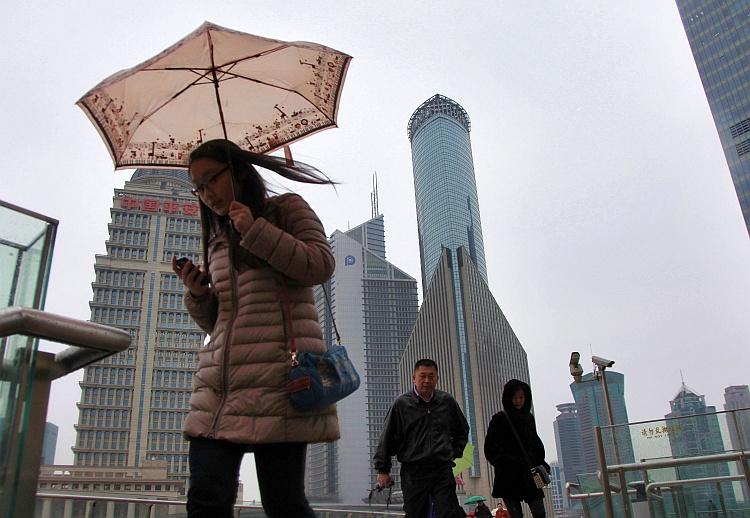

With the ongoing economic turmoil causing jolts to global stock markets, some say that the Asian market, and particularly China, could be in jeopardy.

According to a Barclays Capital study, the recent skyscraper-building boom could be a sign of an inevitable collapse of the economy in China, if history repeats itself.

“There’s an unhealthy correlation between completion of the world’s tallest building and an economic downturn and this unhealthy correlation goes back to the late 1800s and can be seen in New York in the 1930s with the Great Depression and the Empire State Building, the 1970s in Chicago and obviously stagflation and the oil crisis,” said Andrew Lawrence, the director of Asian Property Research at Barclays Capital in Hong Kong and the study’s lead author, in an interview with ABC Australia on Jan. 12.

“And then when it came out of North America it ironically moved to Kuala Lumpur with the Petronas Towers and we had in 1997, as that completed, the Asian Financial Crisis. ... More recently, in 2010 the completion of the Burj Dubai. Somewhat ironically the Burj Dubai became the world’s tallest building in July 2007, just as the debt crisis started,” he added.

Based on the annual research report, mainland China is the world’s dominant skyscraper producer, with 53 percent of the 124 global constructions already underway.

According to Barclays, 80 percent of the new structures are not based along the developed coast of the Pearl River Delta and Yangtze River Delta, which is indicative of the “expanding building bubble.” Furthermore, by 2017 the number of Chinese skyscrapers would have grown almost two-fold from 75 to 141.

Residential property sales have plummeted 40 to 50 percent in the country’s biggest markets, Beijing and Shanghai, according to Lawrence. The overall picture of the property market is rather volatile.

There are also signs that India may be following a similar pattern. The Barclay analyst said that “India, it seems, is playing catch-up ... if history proves to be right, this building boom in China and India could simply be a reflection of a misallocation of capital, which may result in an economic correction in the next five years.”