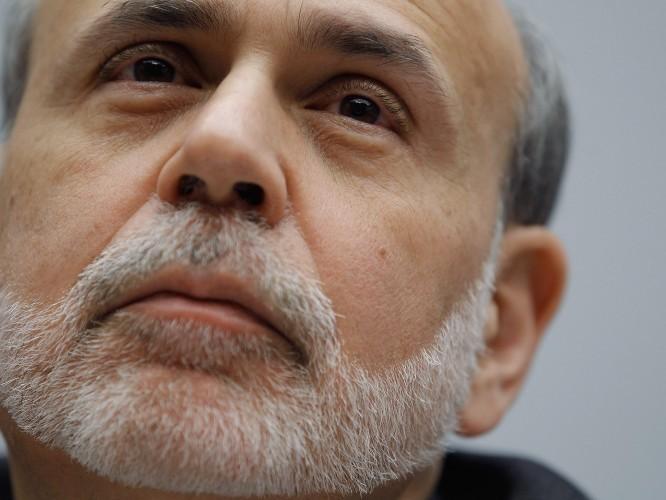

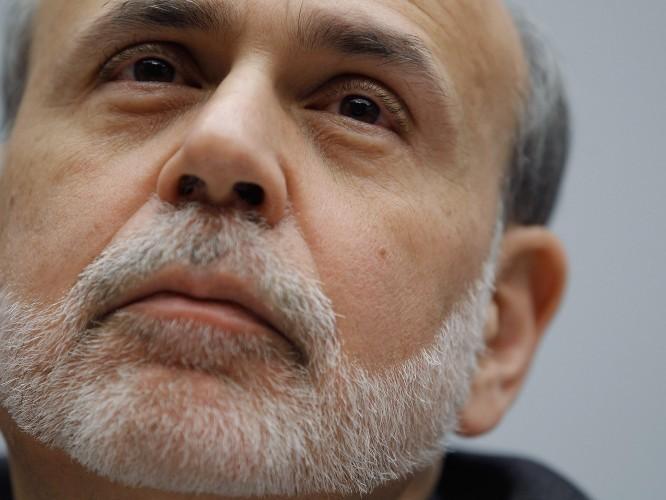

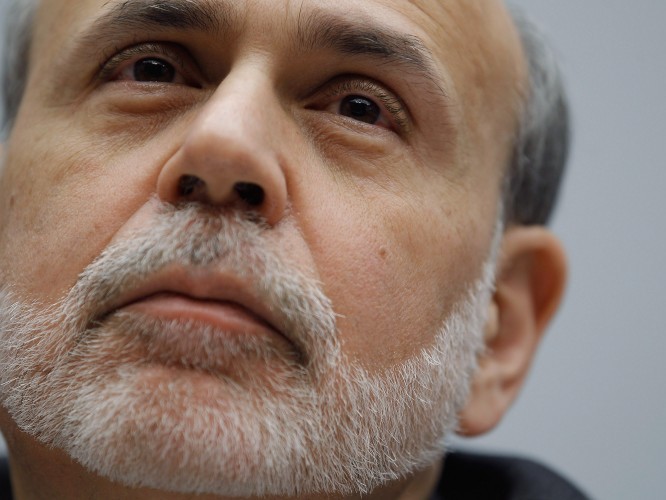

NEW YORK—While recent economic reports have been relatively positive, Federal Reserve Chairman Ben Bernanke warned that economic growth and job growth will remain sluggish for years.

The Fed Chairman gave his semiannual update to the House Financial Services Committee on Wednesday, and reiterated the need to keep borrowing rates near all-time lows. He noted that while the nation’s official unemployment rate has come down, other factors are still weighing on the economy—namely depressed wages, layoffs, and the ongoing European debt crisis.

Bernanke called the recent drop in unemployment rate was unexpected. “Notwithstanding the better recent data, the job market remains far from normal: the unemployment rate remains elevated, long-term unemployment is still near record levels, and the number of persons working part time for economic reasons is very high,” Bernanke said in a prepared speech for the committee.

He noted that continued jobs growth will require more demand and production of goods. Also, the real estate sector has not rebounded as Americans are reluctant to purchase homes due to worries regarding future earnings.

There’s also been a recent spike in oil—and by extension—gasoline prices. Bernanke said those factors could push inflation higher as well as reduce purchasing power of households.

Shares Fall

U.S. stocks slumped on Wednesday following Bernanke’s testimony, and the CBOE Volatility Index (VIX) trended higher.

The Dow Jones Industrial Average fell around 53 points, or 0.4 percent, to 12,952. On Tuesday the Dow closed above 13,000 points for the first time since early 2008, but the rally was short-lived. The S&P 500 Index dropped 6.5 points, or 0.5 percent. The technology-heavy Nasdaq Composite Index fell 19.9 points, or 0.7 percent.

On the equities front, CostCo Wholesale Corp. beat analyst expectations on its fiscal second quarter earnings. “Based on the pulse of the economy, we believe that budget-constrained consumers will remain watchful on their spending and look for discounts,” said Zacks Investment Research in a note. Shares of Costco (Nasdaq: COST) climbed 0.9 percent on Wednesday.

Apple Inc. saw its market capitalization eclipse the $500 billion mark again, ending the trading day at $505 billion after its shares jumped 1.3 percent on speculation surrounding its upcoming iPad 3 unveiling in March.

First Solar Inc. reported a loss and lowered its guidance for the rest of the year. Shares of the world’s biggest makers of thin-film solar panels slid 11 percent on Wednesday. The Arizona-based company lost $413 million in the last quarter, compared with a gain of $156 million a year earlier. It also lowered its 2012 revenue forecast to $3.5 billion, from an earlier estimate of $3.8 billion.

The U.S. dollar fell, and price of gold and silver futures also dropped on Wednesday.

In Europe, the European Central Bank (ECB) disclosed that it had provided low-interest financing totaling 530 billion euros ($712 billion) to around 800 financial institutions. This is the second loan of this kind in less than half a year, and the central bank hopes the funds would be used by the banks to purchase more sovereign debt bonds.