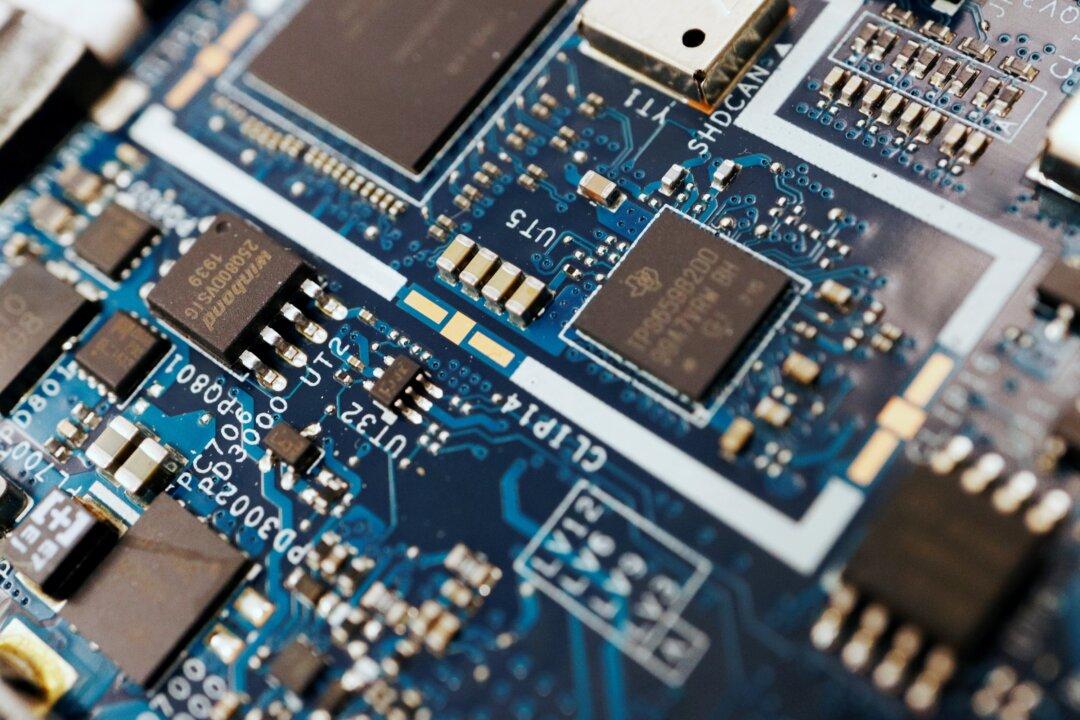

Arm, the British chip designer, which is owned by Japan’s SoftBank, raised nearly $5 billion for its initial public offering (IPO) this week, the largest since 2021.

The firm’s Sept. 14 opening, after filing with the Securities and Exchange Commission (SEC) last month was the largest IPO of 2023, easily eclipsing Johnson & Johnson’s spin-off Kenvue.

This marks the return of Arm to the market after a $40 billion attempt by Nvidia to buy the chipmaker from Softbank in 2020 fell through last year over antitrust concerns.SoftBank acquired the United Kingdom-based semiconductor firm in 2016 for $32 billion and took it off as a public listing.