Commentary

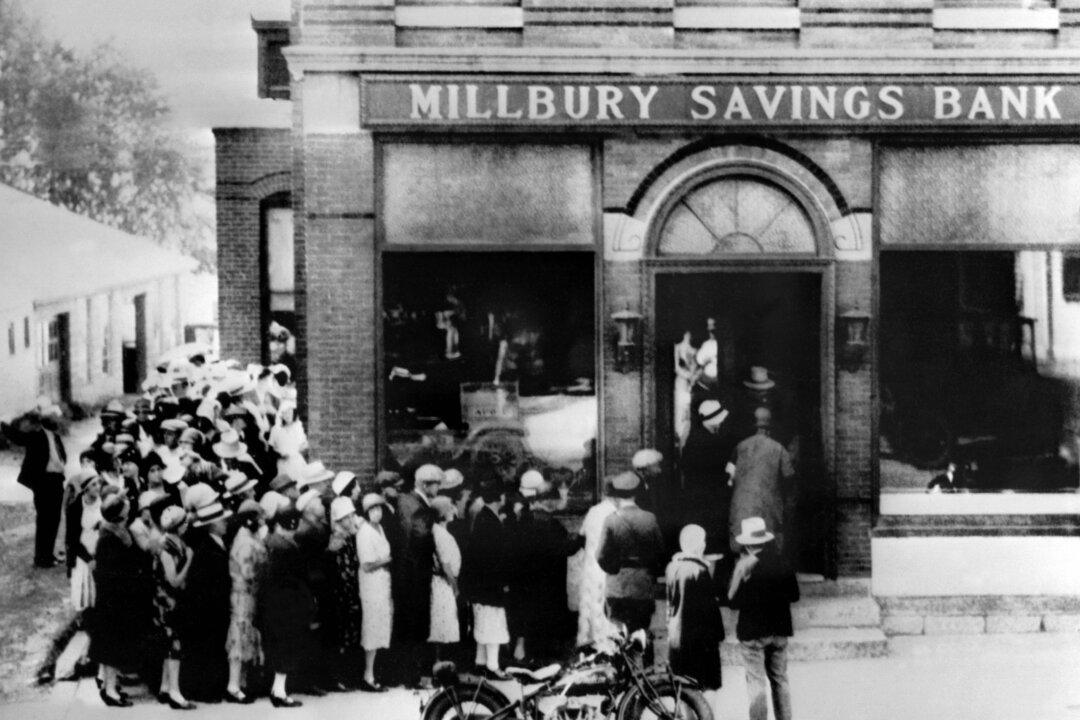

I have studied quite extensively the stock market crash of October 1929, and the Great Depression of the 1930s that followed, for a book I am writing on crisis forecasting. I recently noticed that the current economic and financial conditions have started to align with those that preceded the “Great Crash” in a rather worrisome way.