Medicare spending on weight-loss and diabetes drugs like Ozempic and Rybelsus has “skyrocketed” over the past four years, potentially putting “tremendous pressure” on the program, according to a recent report.

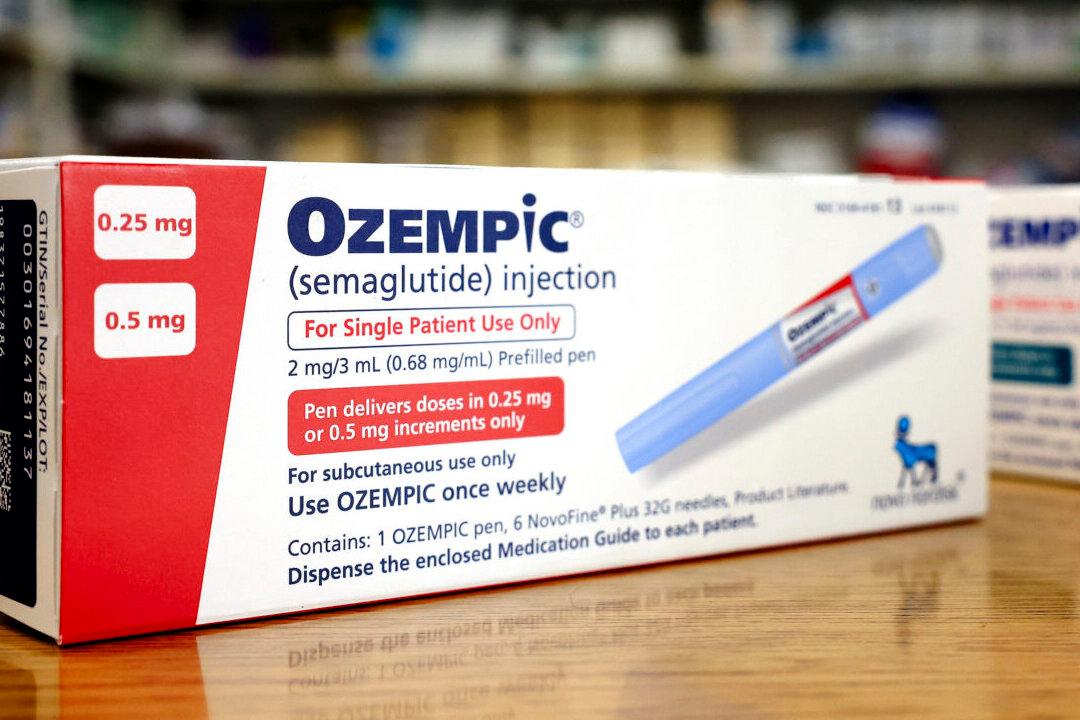

GLP-1 drugs were initially developed to treat type 2 diabetes. However, they are being used for other purposes as well, like treating obesity and reducing the risk of certain adverse cardiovascular events. Medicare is prohibited from covering drugs for weight loss. But Medicare Part D plans can cover GLP-1 drugs for other purposes, including diabetes. As of 2022, Part D covered three GLP-1s for diabetes—Ozempic, approved in December 2017; Rybelsus in September 2019; and Mounjaro in May 2022.