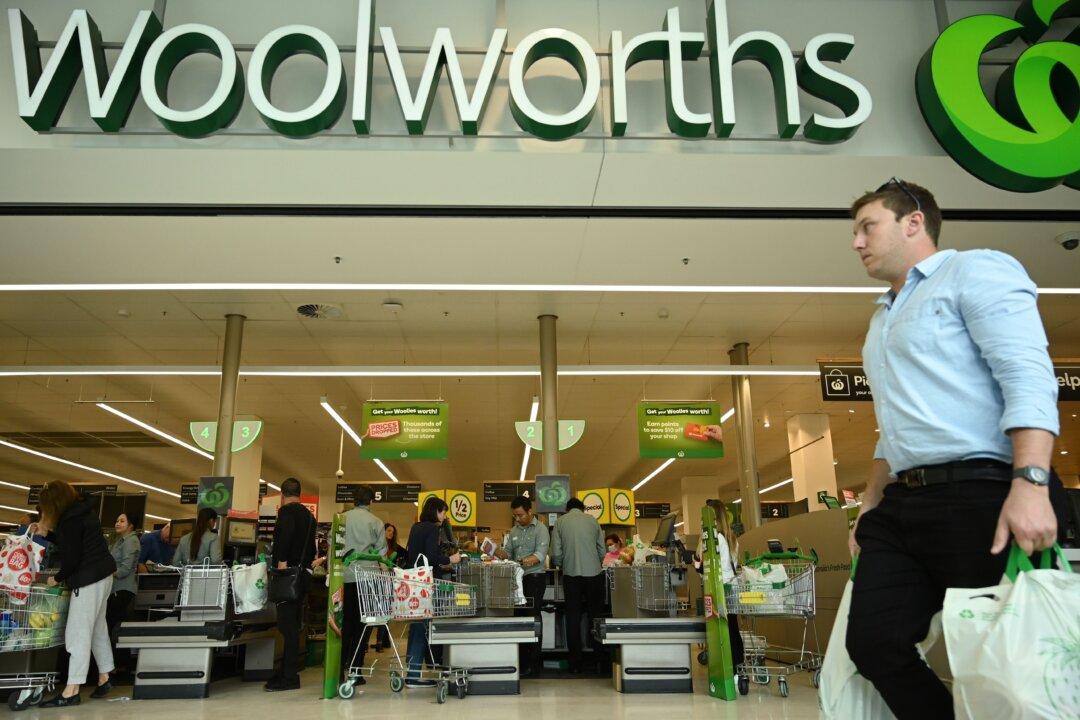

Major Australian grocery chain Woolworths is reducing the amount of cash that can be withdrawn by customers as the country continues its gradual shift toward a cashless society.

A company spokesperson has said that cash withdrawals will be reduced from $500 to $200 due to a lack of people using the service to make transactions.