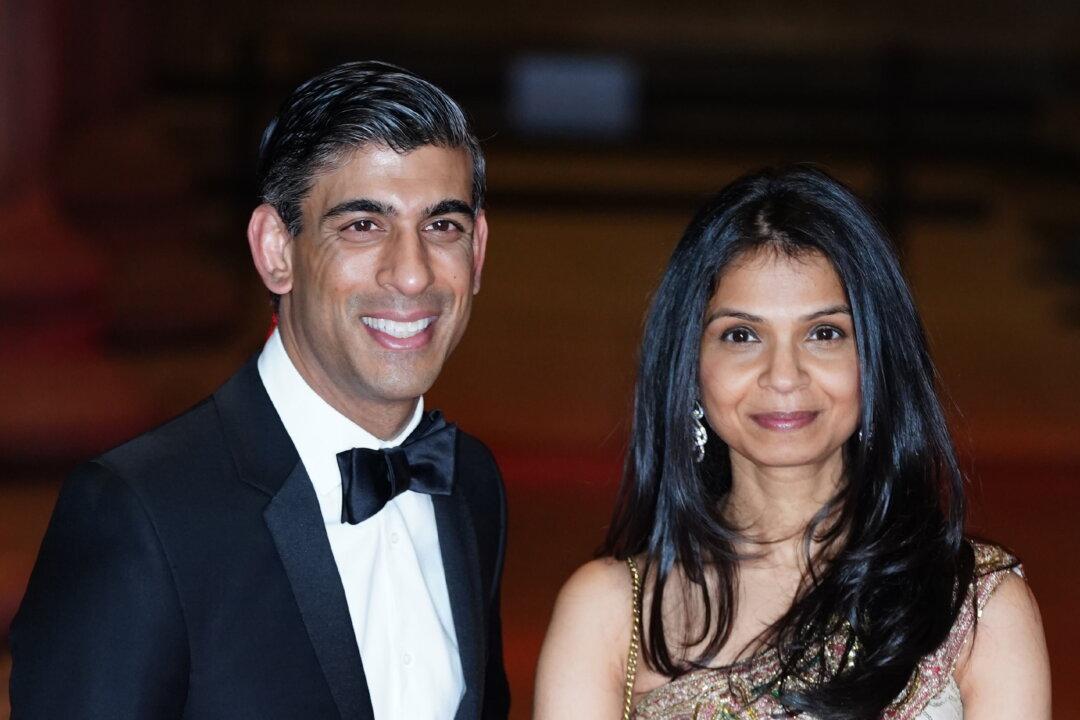

The Indian wife of the British finance minister said she will pay taxes on all her worldwide income in the UK after her financial arrangement came into the spotlight.

Akshata Murty, the wife of Chancellor of the Exchequer Rishi Sunak, said on Friday evening that she made the decision because she didn’t want her non-domiciled status—which exempts her from paying UK tax on foreign income—to be a “distraction” for her husband.