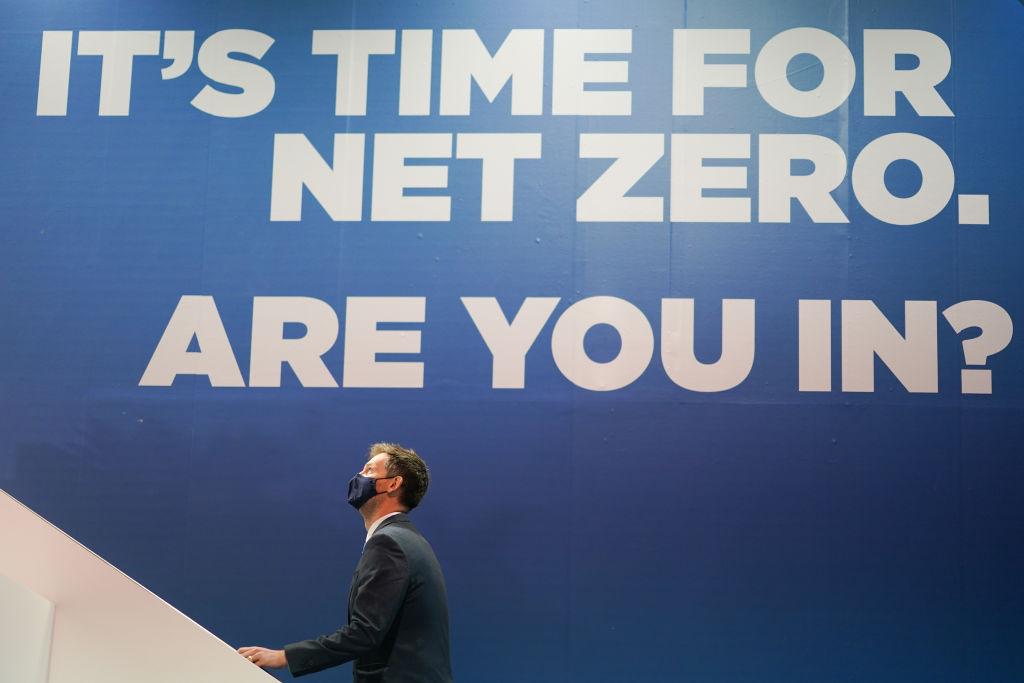

The UK’s competition watchdog published new guidance on Thursday, promising not to go after firms over environmental collaborations using antitrust law.

It come after the United Nation’s Net-Zero Insurance Alliance lost almost two-thirds of its members this year after some Republican attorneys general in a number of U.S. states alleged members of climate clubs may be breaching U.S. antitrust laws.