The acquisition of Britain’s biggest microchip factory by a Chinese-owned technology company is to face a full national security assessment.

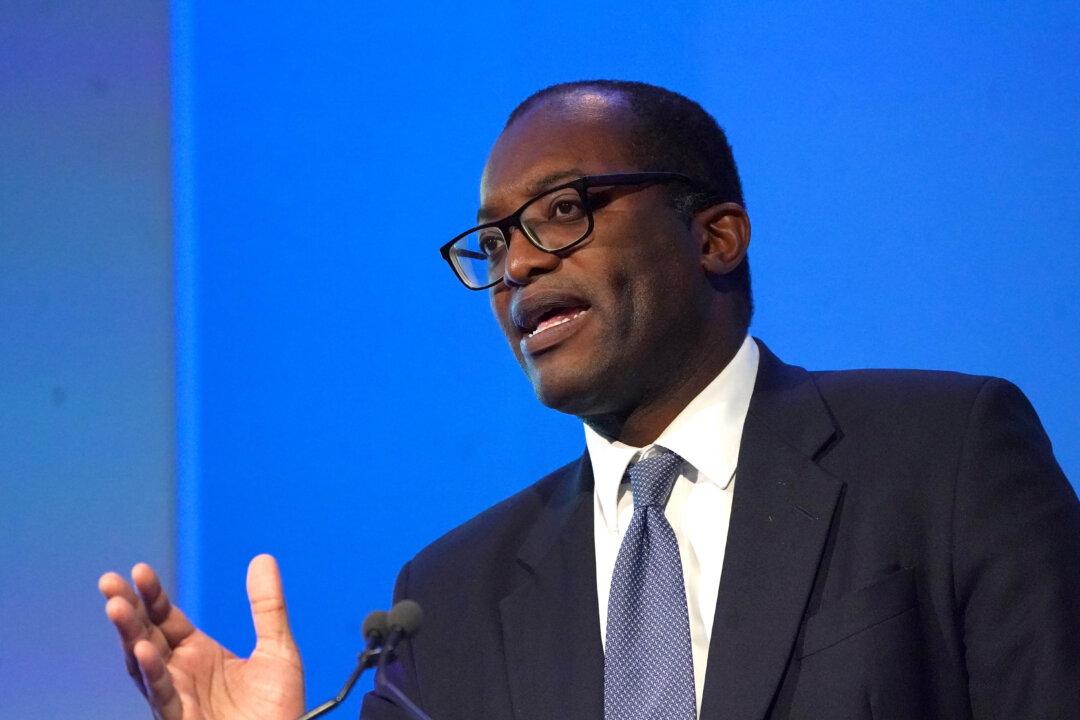

After weeks of pressure from politicians and concerns issued from Washington, the UK’s Business Secretary Kwasi Kwarteng confirmed the government would examine whether the takeover of Newport Wafer Fab by Nexperia, a subsidiary of the Chinese smartphone manufacturer Wingtech Technology, would pose a threat to national security.