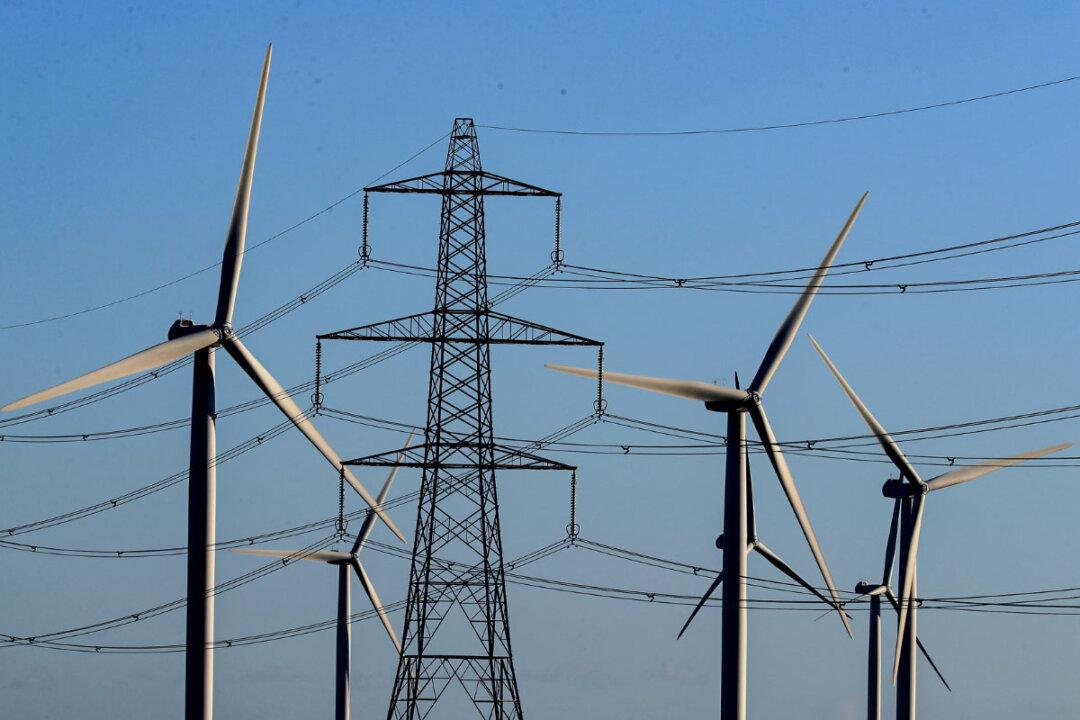

The government is exploring major reforms to the UK electricity market by introducing zonal pricing, a system where electricity costs differ by region rather than being the same nationwide, to better align with local supply and demand.

First proposed by the Conservatives in 2022 and now under review by Labour, the reform could divide Britain into seven energy market zones, each with their own market price.

Under this system, areas with high clean energy production and low demand, like Scotland, would have lower prices, while high-demand areas with limited renewables, such as southern England, would pay more.

Currently, Britain operates under a single national wholesale electricity price.

According to the National Energy System Operator (NESO), responsible for managing and planning UK’s electricity and gas systems, this pricing model doesn’t take network constraints into consideration, whereby electricity cannot flow freely from where it is generated to where it is consumed.

Zonal Pricing

Guy Newey, chief executive of innovation centre Energy Systems Catapult, has suggested that the UK’s electricity grid is at breaking point and unable to deliver power where needed. He said that building more wind and solar energy sources is not enough, calling for an immediate introduction of a zonal market.“We need to bridge the gap between when clean power is produced and when it is used. There’s only one way to do that: clean flexibility,” Newey said.

However, critics warn that zonal pricing could slow investment and increase costs for businesses forced to move to areas with cheaper electricity.

Some of the UK’s largest trade groups, including UK Steel and Make UK, have said that zonal pricing would push up manufacturers’ costs and produce “electricity price winners and losers.”

“A miles-wide steel plant simply cannot up and leave to get access to lower power prices elsewhere. This is before we consider the billions invested in operations, let alone the workers who could get left behind,” said UK Steel’s director of energy and climate change policy, Frank Aaskov.

Scottish Renewables has called on Whitehall to urgently rule out zonal pricing to ensure continued investment in Scotland.

Andrew MacNish Porter, head of economics and markets at Scottish Renewables, told The Epoch Times that zonal pricing could lead to unpredictable price swings. He said that consumers and businesses would have little choice but to absorb these fluctuations, while energy investors face greater risks.

“Zonal pricing would result in a postcode lottery for consumers, and to a large extent to the industrial sector, because businesses are unlikely to pack up shop and move just because of electricity prices,” said Porter.

Clean Power Targets

Zonal pricing is one of the proposals under the Review of Electricity Market Arrangements, a government initiative that seeks to redesign the market to align with the ambition to fully decarbonise the power sector by 2030.The Clean Power 2030 target is meant to make the UK more resilient to future energy shocks, such as price spikes caused by global conflicts like the war in Ukraine.

Labour’s push on renewable energy comes amid warnings by analysts that the government may miss its renewable energy targets.

Tom Musker, a senior analyst at Cornwall Insight, stressed the need for clarity on market reforms, warning that moving too fast could hurt long-term energy security.

“The government’s push towards a fully decarbonised grid represents an opportunity to cement the UK’s position as a global leader in renewable energy. However, while setting ambitious goals for renewables is crucial, some argue that pushing too quickly could have unintended consequences, diverting resources to short-term solutions at the expense of longer-term energy security and sustainability,” he said.

Energy Secretary Ed Miliband has rejected the report’s figures and said that reaching the 2030 clean power target is “challenging” but “doable.”

In November, energy minister Michael Shanks said that the current system is outdated and doesn’t address modern needs. He noted that Scotland, as a net energy exporter, has lower transmission costs compared to other regions, but added that delivering electricity to homes in the areas like the Highlands is more expensive.

International Experience

The UK’s national pricing model is also used in countries like France, Germany, Poland, and Greece. In contrast, nations like Australia, Italy, Sweden, Norway, and Denmark operate under a zonal pricing system.E.ON, one of Europe’s largest electricity and gas providers, has previously warned that splitting Germany’s single wholesale electricity market could cause major disruption, posing a threat to Europe’s renewable energy transition.

The Essen-based company also highlighted the risk of price and investment disparities between northern and southern Germany, as well as a growing reliance on government support mechanisms.

“To compensate for a less attractive environment for renewable energy investment, government support schemes, such as feed-in tariffs or subsidies, would be essential,” E.ON said.

Norway, which has a deregulated electricity market, uses zonal pricing to manage network capacity issues.

In February, the Norwegian government announced new measures to lower electricity costs and shield households from price fluctuations.

Porter argued that zonal pricing would not significantly reduce energy bills. He emphasised that implementing such a system would take at least five years, making it an ineffective solution to the immediate challenges facing consumers.

The government said that its £40 billion annual investment in clean energy between 2025 and 2030 will help shield consumers from price volatility and lower energy bills in the long run.