A new plan to link the UK and China’s exchange-traded fund (ETF) markets could enhance Britain’s status as a global financial hub and attract investment, analysts have suggested.

After Chancellor Rachel Reeves’s recent visit to China, the government announced plans to evaluate the feasibility of a UK–China ETF Connect, a scheme to provide investors in both countries with easier access to each other’s markets.

ETFs are investment funds that trade on stock exchanges, much like individual stocks.

They make it easier to invest in a bundle of assets all at once. For instance, a FTSE 100 ETF allows you to invest in the 100 largest companies in the UK, like HSBC or Shell, with just one purchase.

If launched, the UK–China ETF scheme could increase the interest in both sets of listed products, increasing investor interest and liquidity, said the co-CEO and co-founder of the independent ETF provider HANetf, Hector McNeil.

“It also hopefully means we could see more Chinese investors interested in UK listed stocks available through ETFs like the FTSE 100 and 250,” he added.

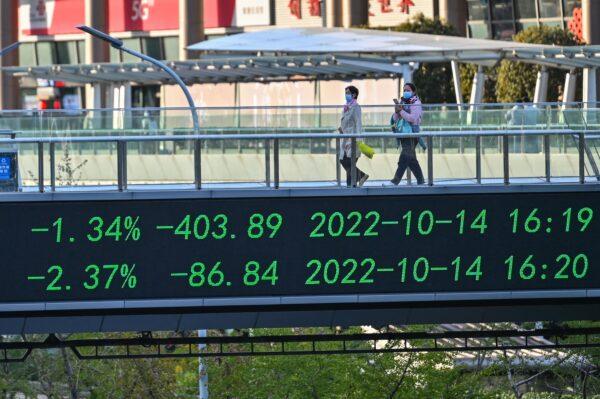

Some 88 companies delisted or transferred their primary listings from the main market. A number of transfers were to the United States, which the companies said offers “deeper capital pools and higher trading volumes.”

“The LSE has been losing listings especially to the U.S. markets. If the U.S. markets get more hostile to Chinese companies—e.g. TikTok—it will give the UK markets a chance to step in,” said McNeil.

Speaking about the role of the ETF Connect scheme in the broader competition between global financial hubs like London, New York, and Shanghai, McNeil said that removing friction in investment and cap markets is the “key to success.”

Risks and Challenges

The UK-China ETF Link may come with enhanced political and regularity risks, as well as liquidity issues, according to Kenneth Lamont, principle at independent investment research provider Morningstar.“From a UK investor’s perspective, it is likely to lead to a broader array of China-focused investment options and potentially reduce of the cost of accessing Chinese equities. ETFs are generally listed and available for purchase by both retail and institutional clients.

“This of course brings risks too. Emerging markets can offer growth opportunities not seen in developed markets, but can also be more volatile.

“Particularly important for investors looking at China is the heightened political and regularity risk as well as liquidity issues which may not become apparent until periods of market stress,” he said.

Other concerns over the feasibility of the scheme include logistical hurdles, as well as differences in opening hours and regulation.

McNeil suggested that UK and Chinese asset managers will need to consider how to physically distribute and promote their ETFs. Speaking about the challenges to UK investors, he added: “The range of Chinese ETFs available in China are much more significant and a deeper range than is available locally in Europe. Therefore if a UK investor wants a more granular investment, e.g. Chinese EV car sector, then this should allow them to execute a more accurate investment.”

He also acknowledged the benefits of ETFs, describing them as the “most democratic wrapper available to all investors.”

“Because the minimum investment is one share, retail investors can access an ETF easily through their brokerage account and get the same access for the same costs as a large institutional client who may want to be able to buy 1 million shares,” he said.

With physical ETFs, investors directly own the assets they track; for example, a gold ETF holds actual gold in a vault.

MPs Push Back

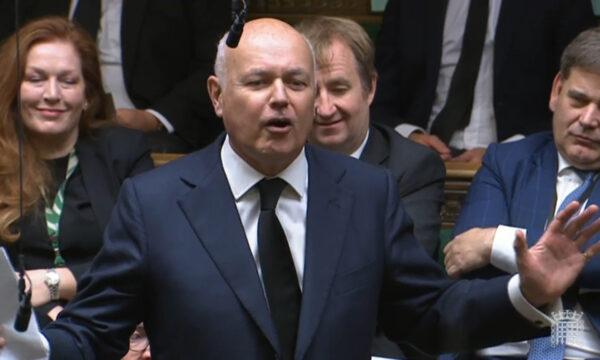

The proposal of the ETF scheme comes amid a pushback against closer ties with China by UK parliamentarians. This includes shadow chancellor Mel Stride and former Tory leader Sir Iain Duncan Smith, who was sanctioned by Beijing in 2021 for speaking out against the CCP’s abuse of Uyghur Muslims.

The chancellor said that Britain’s economy will benefit from a £600 million boost thanks to the deal with China. Both sides have pledged “to further their financial services relationship” and “deepen cooperation” in wealth management.

The UK has also welcomed China’s decision to grant new commercial licences and quota allocations for UK firms, including HSBC, Schroders, abrdn, and Aspect Capital.

Liberal Democrat Treasury spokeswoman Daisy Cooper described the £600 million as “small beer.” She added that Reeves “should not have gone to China unless there was a commitment that Jimmy Lai was going to be released.”

Geopolitical Context

China is currently the UK’s fifth-largest trade partner, behind Germany, the Netherlands, France, and the United States, which leads with 17.6 percent of the UK’s total trade.While the United States remains a critical partner, the UK has been recalibrating its trade relationships post-Brexit, seeking to diversify and strengthen economic ties globally.

Lamont noted that Britain is “concerned about retaining its position as a global financial centre,” while China is eager to reduce its dependence on the United States. He emphasised that initiatives like the ETF Connect scheme are “in both the UK and China’s immediate interest.”

The dynamics of the U.S.–China relationship add complexity to global trade. U.S. President Donald Trump has previously pledged tariffs exceeding 60 percent on Chinese goods and supported banning the Chinese-owned app TikTok on national security grounds. However, he delayed enforcement to allow more time for negotiations.

According to McNeil, the flexibility provided by initiatives like the ETF Connect scheme could be crucial for Britain if U.S. policies towards Chinese companies remain stringent.