LONDON—Surging new orders before an easing of COVID-19 lockdown restrictions has prompted a stronger rebound for British companies than expected this month, although price pressures are rising sharply, too, a business survey showed on Wednesday.

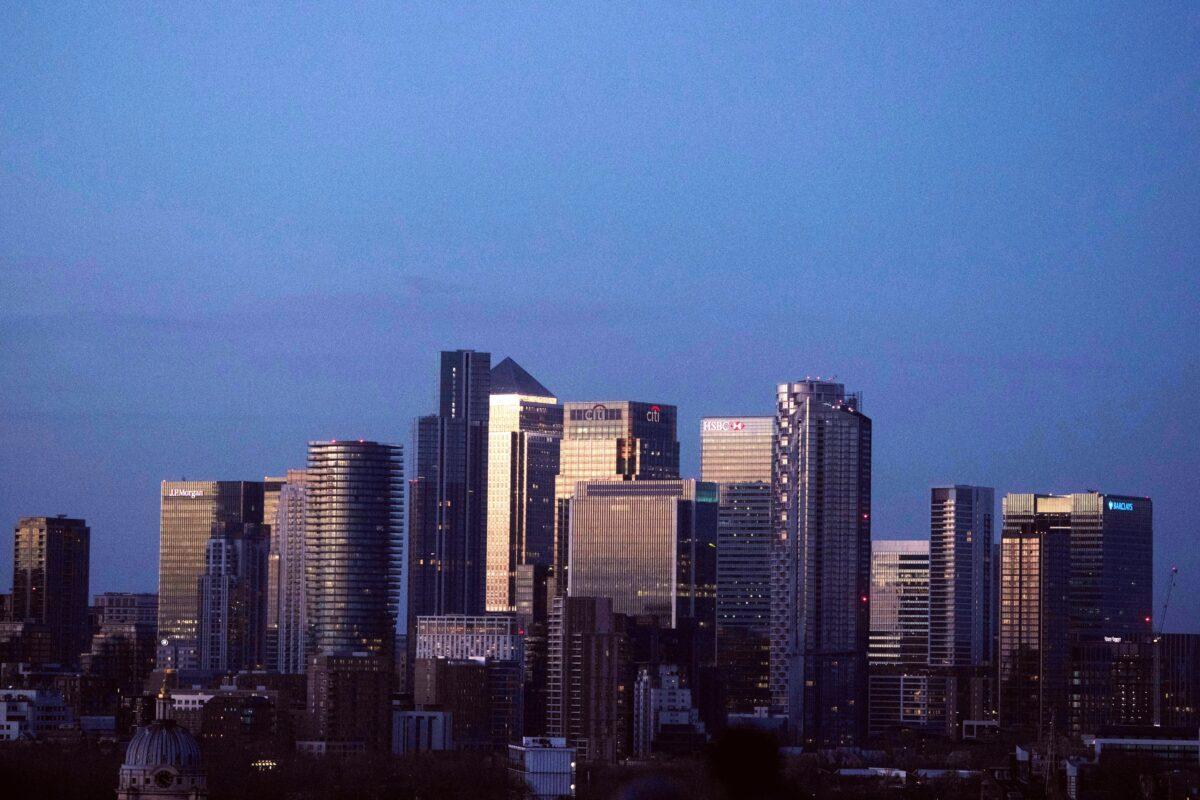

Canary Wharf stands in London, Britain, on Dec. 27, 2020. Simon Dawson/Reuters