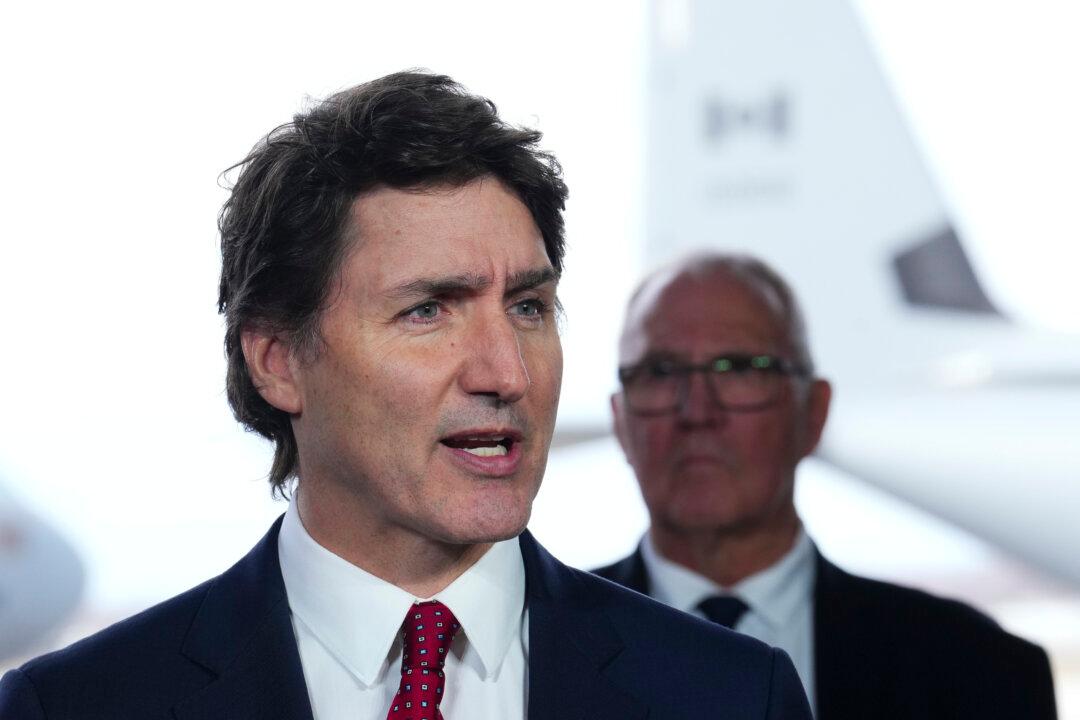

Prime Minister Justin Trudeau is pushing back at growing criticism of his government’s move in the 2024 federal budget to raise the capital gains tax.

Mr. Trudeau defended the tax hike as fairness for younger generations when asked by reporters in Saskatoon, Saskatchewan, on April 23 about statements made by former Liberal finance minister Bill Morneau a week earlier.