Canada’s trucking industry is grappling with a host of pressing issues that have been exacerbated by the pandemic, with industry stakeholders warning of driver shortages, high turnover rates, and undesirable working conditions.

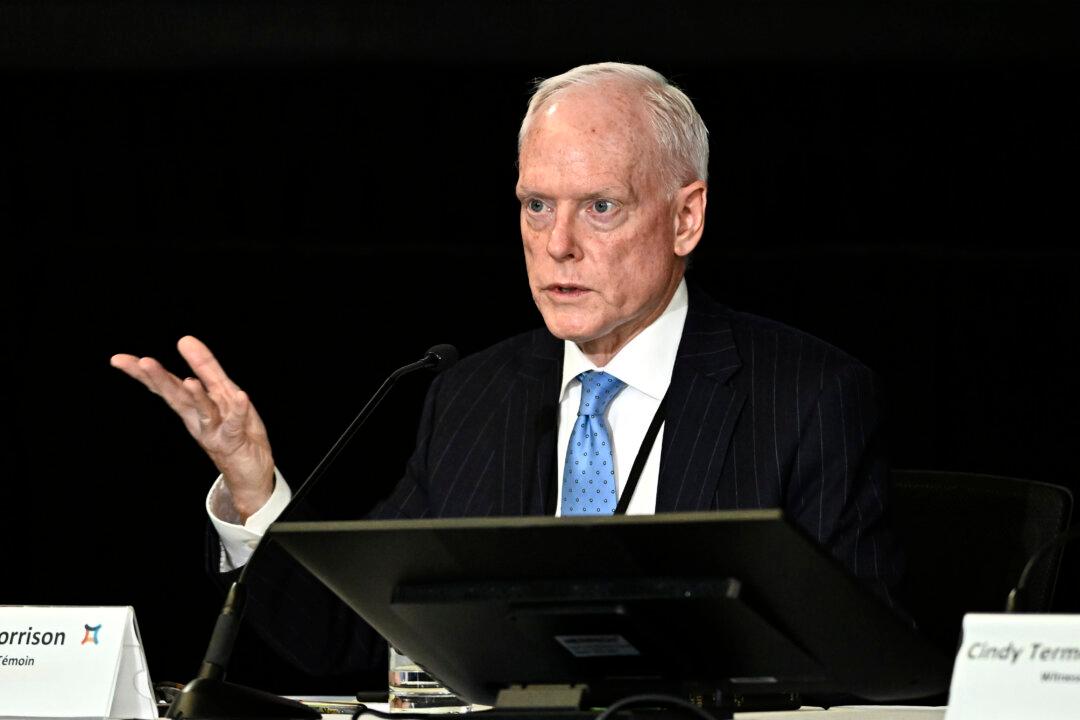

“We had a significant truck driver shortage prior to COVID and it’s only been made worse by the crisis,” Stephen Laskowski, president of the Canadian Trucking Alliance (CTA), told The Epoch Times.