Toronto Police Service (TPS) has arrested 10 individuals and laid over 100 charges in a major “SIM swap” fraud investigation.

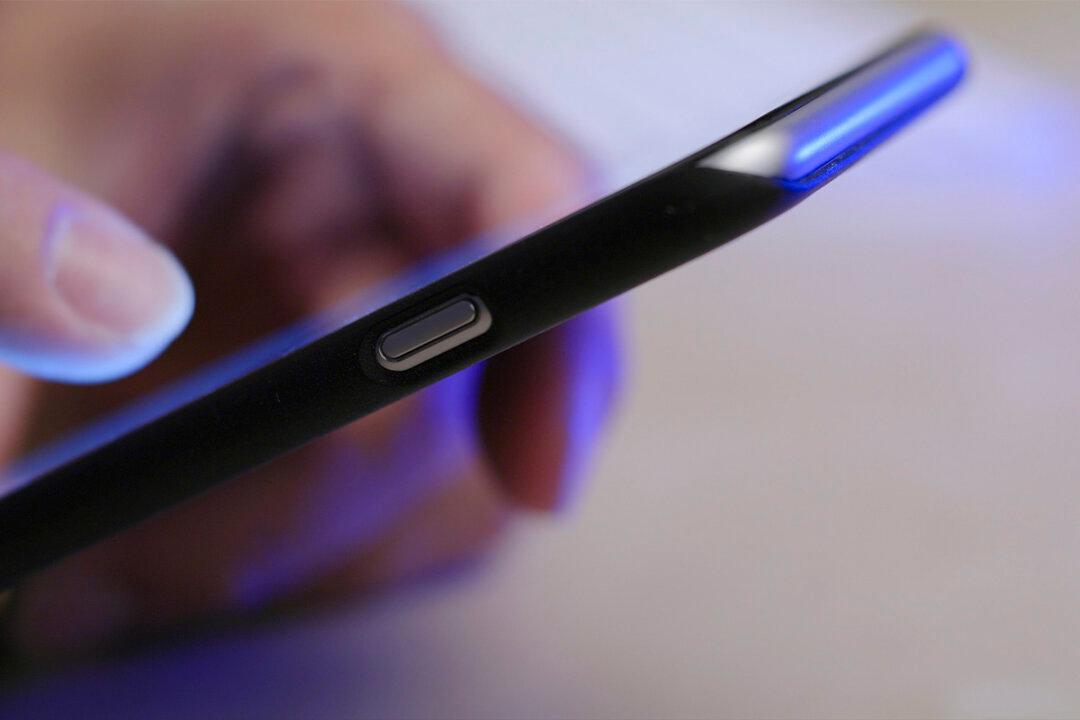

SIM swapping is when someone takes over a victim’s cellphone number by exploiting weaknesses in two-factor authentication. The perpetrator often contacts the victim’s phone provider and convinces them they are a client. They then switch the SIM card associated with their account, allowing the criminal to gain access to the phone and receive text messages for password recovery or changes. They can also access social media accounts, bank accounts, and email accounts.