The Conservatives have promised a so-called triple lock plus deal for pensioners if they win the general election, but Labour has refused to match the offer, saying it is not “credible.”

Income tax is paid on money received via private pensions but those whose only income is their state pension do not pay tax on it.

But by 2027 the Office for Budget Responsibility (OBR) estimates the state pension would be higher than the tax-free personal allowance, which is currently £12,570.

The state pension rises by whichever is highest—average earnings, wages, or by 2.5 percent—which is known as the triple lock.

Last month the state pension rose by 8.5 percent.

The Tories say pensioners should not pay tax so they plan to increase the personal allowance for pensioners by at least 2.5 percent or in line with the highest of earnings or wages.

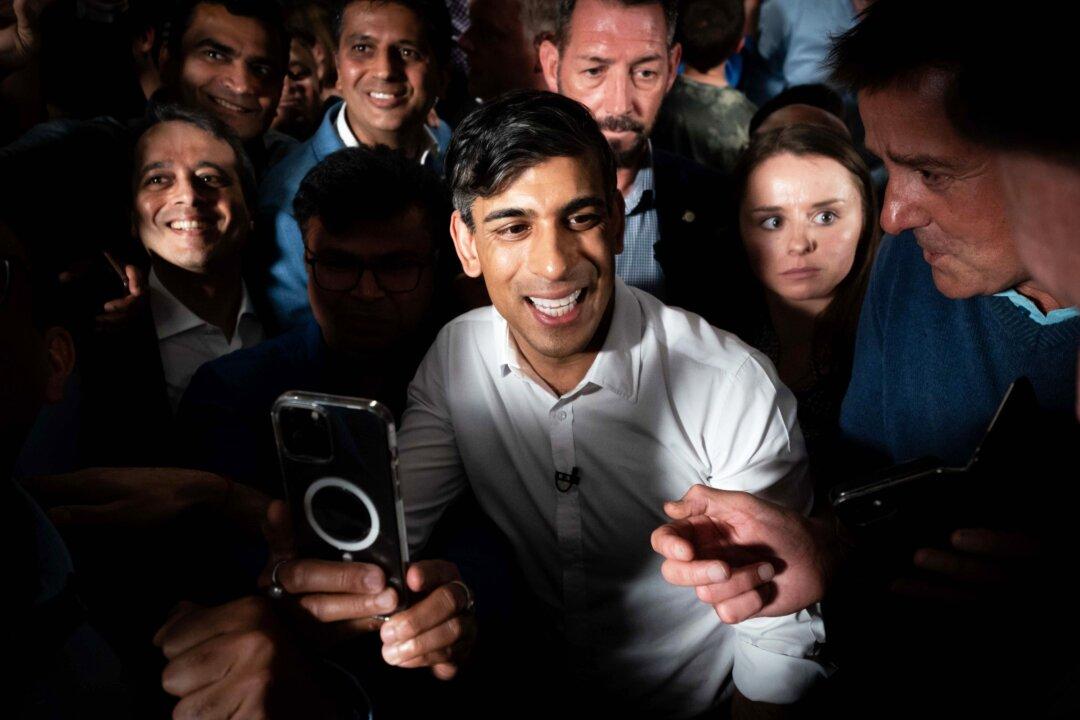

Prime Minister Rishi Sunak said pensioners would be worse off by £275 a year under Labour by 2030 and he said the scheme “shows we are on the side of pensioners.”

Labour said the plan was not “credible” and shadow chancellor Rachel Reeves said the triple lock plus was on top of £64 billion worth of unfunded tax cuts the Tories had already pledged.

Stride Says Clampdown on Tax Avoidance Will Fund It

He told Times Radio, “We can comfortably raise £6 billion from clamping down on tax avoidance and evasion and that figure, in fact, is very much in line with the kind of figures that we’ve achieved in the past.”“In fact the head of the National Audit Office has actually stated that that number is achievable and that is where the fully funded costing will be met,” added Mr. Stride.

Asked about this on Times Radio, Mr. Stride said, “It’s £2.5 billion per year, which will be £1 billion coming from avoidance and evasion and one and a half coming from levelling up funding, so that’s where you get the two and a half.”

“So we’ve got 6 [billion] that we’re saving through avoidance and evasion … £1 billion of that is going into the national service and the remainder is going to fund this important tax cut for our pensioners,” he added.

Earlier Mr. Stride told Sky News the policy would mean millions of pensioners getting a “tax cut through time.”

Lib Dems Say ‘People Won’t Be Fooled’

The Liberal Democrats’ Treasury spokeswoman Sarah Olney said, “The Conservative Party has hammered pensioners with years of unfair tax hikes and broken their word on the triple lock.”“People won’t be fooled by yet another empty promise from Rishi Sunak after this record of failure,” she added.

Paul Johnson, the director of the Institute for Fiscal Studies think tank, told BBC Radio 4’s “Today” programme: “Pensioners used to have a bigger personal allowance than people of working age. It was the Conservatives who got rid of it.”

“So this is one of many examples actually of tax policy that has been reversed by the same government. George Osborne got rid of it in the 2010s when the personal allowance of people under pension age continued to rise,” he added.

“Secondly, it’s worth saying that in part, looking forward, this is simply a reversal of a tax increase that the Conservatives proposed. The idea is that the allowance doesn’t rise at all in line with inflation for the next three years. So half of the cost of this is simply not imposing the tax increase that was previously proposed,” added Mr. Johnson.

The OBR has estimated the freeze on the personal tax income threshold, which has been in place since 2021, will create 4 million extra taxpayers by 2028.

Ms. Reeves, speaking at the Rolls-Royce factory in Derby on Tuesday, said: “The Conservatives are insulting the intelligence of millions of people like these forced to deal with the consequences of their failure. But we won’t let them get away with it. Because the Conservatives do deserve to be judged on their record of those 14 years.”

“Five prime ministers, seven chancellors, 12 plans for growth, each delivering less than the last. To put it in perspective, if our economy had grown at the average rate of OECD countries these last 14 years, our economy today would be £150 billion larger, worth £5,000 for every household and providing £55 billion more investment for our public services,” she added.