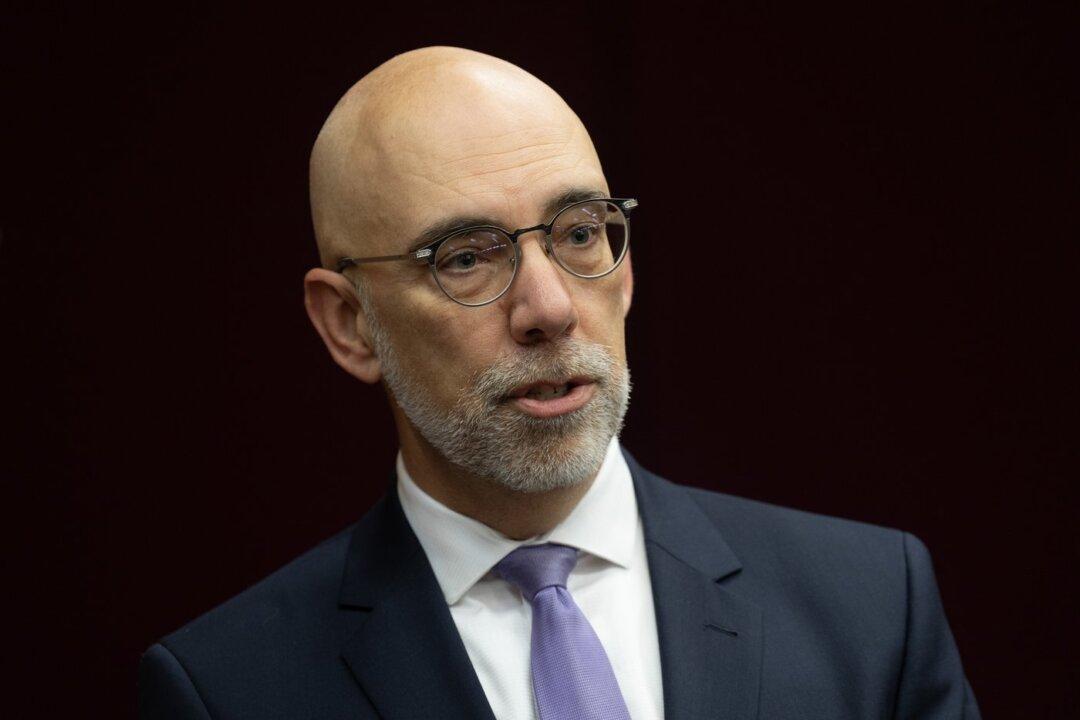

Parliamentary Budget Officer Yves Giroux warns that the Canadian economy will see “sluggish” growth in 2024 and that an increase in government spending may necessitate raising taxes.

“The picture for this year in fact is very sluggish growth due to the impact of the monetary policy, the increase in interest rates that we have seen over the last several months, as well as slow economic growth from the consumer side,” Mr. Giroux said during a March 10 interview on CTV News.