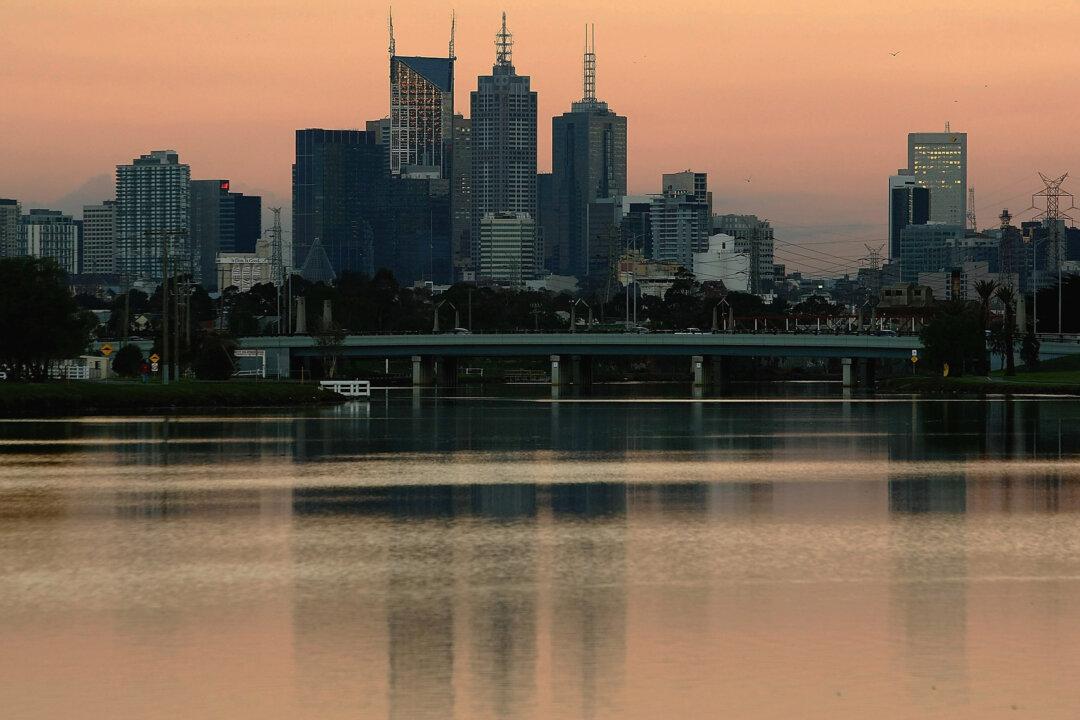

The vacancy rate for Australian office space has reached a 24-year high amid reduced demand during the CCP virus pandemic, at the same time new supply continues to pour onto the market.

A Property Council of Australia Office Market report for the six months leading to January 2021 found the vacancy rate for Australia’s office market increased from 9.6 percent to 11.7 percent—its highest level since January 1997.