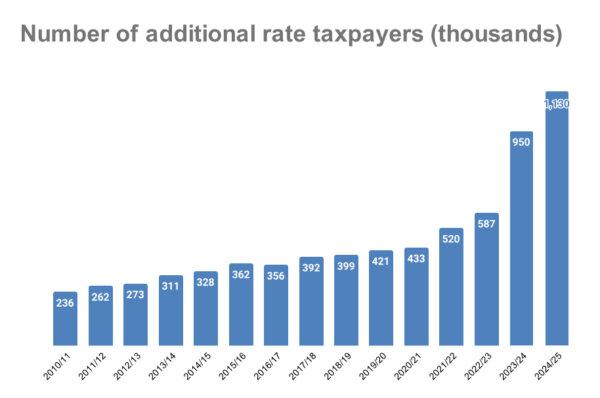

The number of UK taxpayers liable to pay the top rate of income tax is set to reach 1 million for the first time as more people are dragged into the bracket amid an ongoing threshold freeze.

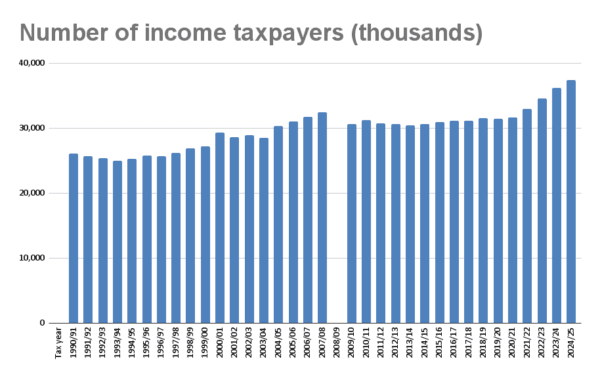

The total number of taxpayers has also jumped by millions in the past three years, according to figures published by HM Revenue and Customs (HMRC) on Thursday.

The threshold freeze, which began in April 2021, is set to continue for another three years, meaning HMRC can stealthily raise more taxes without raising tax rates, and no party has mentioned a reversal of the policy in their campaign pledges.

According to HMRC estimates, the number of “additional rate” taxpayers, whose tax rate is 45 percent for part of their income, will reach 1.13 million in 2024/25, compared to 950,000 in the previous year, and it’s more than double the number in 2021/22 (520,000).

The amount of taxes paid by the group this year is estimated to be £124 billion, 53 percent more than that in 2021/22 (£80.8 billion).

The total number of people paying income tax has also seen a sharp increase, from nearly 33 million in 2021/22 to over 36.2 million in 2023/24.

It’s set to reach 37.4 million this year, representing a 13.5 percent increase since tax thresholds were frozen, and a 33 percent increase in total annual income tax revenue, according to HMRC estimates.

It’s possible that population growth has also contributed to the increase, however estimates by the Office for National Statistics suggest the size of the workforce has only grown by around 2.2 percent since early 2021.

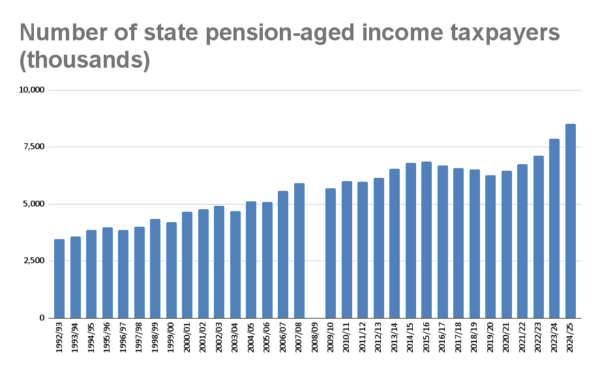

Meanwhile, the number of of pensioners who pay income taxes is expected to increase by more than a quarter, from 6.74 million in 2021/22 to 8.51 million in 2024/25.

The threshold freeze, which means tax thresholds do not rise in line with inflation, is set to continue until 2027/28, dragging more people into the higher tax bracket.

Top 10 Percent Pay Most Taxes

With the UK’s tax burden at the highest level in over 70 years, Chancellor Jeremy Hunt said earlier this year that the average earner in the UK had the lowest effective personal tax rate in almost 50 years.With regard to income taxes, top earners have been paying most of the taxes while the bottom half are paying less. This trend is set to continue, according to HMRC estimates.

In 2024/25, the top 1 percentile group is expected to earn 13.3 percent of the total income while paying 28.2 percent of income taxes.

The top 10 percentile group is expected to earn 35.1 percent of the total income while paying 60.2 percent of income taxes.

The bottom 50 percentile group is expected to earn 24.2 percent of the total income while paying 9.5 percent of income taxes.