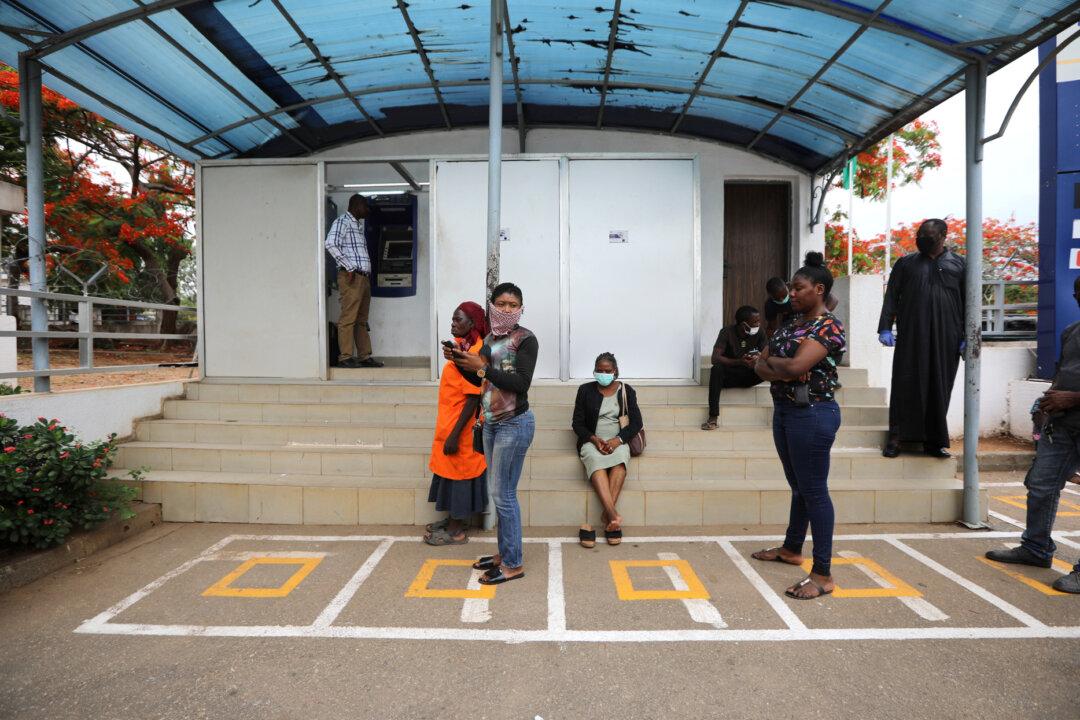

Nigeria is set to begin limiting cash withdrawals from ATMs to just US$45 a day as the country moves toward its goal of becoming a cashless economy and embraces digital currency, including its own “eNaira” cash.

In a letter (pdf) to all banks and other financial institutions sent on Dec. 6, Nigeria’s Central Bank said they must comply with new rules pertaining to over-the-counter and ATM withdrawals.