A record-high tax burden, big public debt, and a sluggish economy will leave the next UK government in the biggest quandary in 70 years, according to the Institute for Fiscal Studies (IFS).

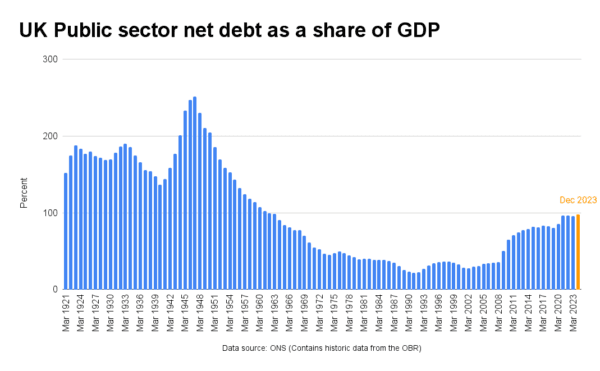

The think tank said while both the Conservative Party and Labour have promised to reduce debt as a share of national income, it will be more difficult to deliver that promise “over the next parliament than in any other parliament since the 1950s.”

It warned that immediate tax cuts will “add to the risk of tax rises or spending cuts tomorrow.”

The UK’s debt-to-GDP ratio stood at 97.7 percent last month. It was around 200 percent in the 1950s, when the UK was in the aftermath of two world wars.

In a report published on Thursday, the IFS said a new government will inherit stagnant living standards, record-high taxes, and struggling public services, and the tax rises and spending cuts already planned are “only just enough to stabilise” the debt burden.

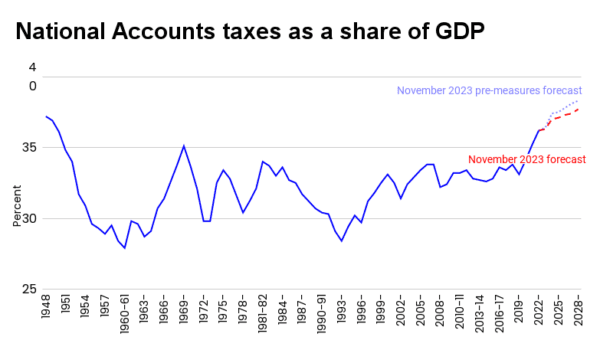

The UK’s tax burden—tax receipts as a share of GDP—is somewhere in the middle compared to other advanced economies, although it has grown to the highest level since 1950, at 36.2 percent in the last financial year.

Meanwhile, a stagnant GDP means tax receipts will be stagnant as well when demand for spending grows.

“This will be a thorny inheritance for whoever is in office after this year’s general election,” the report said.

“Both Labour and the Conservatives have promised to reduce debt as a fraction of national income. Yet a combination of high debt interest payments and low growth is forecast to make this much more difficult to achieve than in the recent past.”

The think tank warned against tax cuts, saying, “it might be easy to announce immediate tax cuts, without any hint of what it is the state currently does that it will stop doing, or what taxes will rise in future, but this trade-off cannot be wished away.”

It also said that public investment is expected to fall, and that the next government would have to choose between maintaining living standards today and invest in further growth if it can’t borrow more.

“Higher investment might boost our future prosperity but, without scope to increase debt, would mean less consumption now—a difficult ask when living standards have been squeezed for so long.”

In a statement emailed to The Epoch Times, a Treasury spokesperson said: “Our decisive action to halve inflation and ensure debt falls as a share of the economy means we are now beginning to turn a corner, which is why we can afford tax cuts for 27 million working people this month.

“The best way to deliver sustainable funding for public services in the future is to grow the economy—the UK has grown faster than France, Germany, and Japan since 2010 and the OBR say our action in spring and autumn will deliver the largest boost on record.”

A Conservative Party spokesman told the BBC that the report “shows Labour’s £28 [billion] a year ‘2030’ unfunded spending promise will end up meaning thousands of pounds of higher taxes for working people.

“That’s because [Labour leader Sir] Keir Starmer can’t say how he would pay for it as he does not have a plan,” the statement reads.

The Epoch Times has reached out to Labour for comment.

Richard Hughes, chair of the OBR, told the Economic Affairs Committee this week the government is not facing problems with selling more debt in the near term, but the current fiscal model causes will not be sustainable in the long term with an ageing society.