The Canadian government is planning to rewrite regulations governing the amount of interest that can be charged on a loan, and one of the country’s largest law firms, Bennett Jones, says it is monitoring the proposed changes and consultation process.

Canada’s law on interest charges was last modified in 1978. Bennett Jones said the government is launching consultations to decide if the rate should be reduced even further.

Bennett Jones said it is “crucial the government understands effects, specifically on corporate entities, of altering the criminal interest rate as the potential risks and benefits to corporate lenders and borrowers may be material.”

The law firm advised that reducing the maximum allowable charge on interest “may restrict options and flexibility for corporate lending, borrowing and investing” on short-term share issues or corporate warrants.

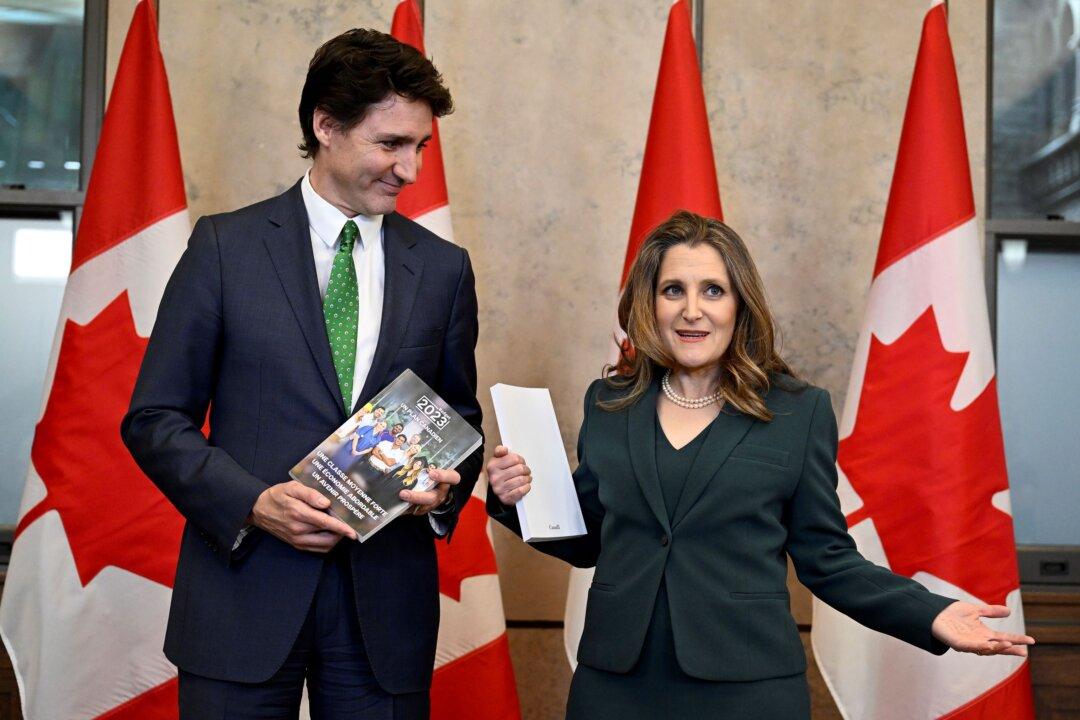

The federal government said it would conduct consultations following the new federal budget, which announced the Liberals’ intention to change the Criminal Code to lower the rate of interest that can be charged to consumers under the Criminal Code.

Chrystia Freeland, in presenting the March 28 budget, said the Criminal Code definition of usury—which is currently interest charged at more than 60 percent a year—would be amended and reduced to a maximum interest rate on most loans of roughly 42 percent per year, according to an April 10 report by Blacklock’s Reporter.

“Predatory lenders can take advantage of some of the most vulnerable people in our communities including low income Canadians, newcomers and seniors,” Freeland said.

The new budget also suggests Parliament will reclaim regulating payday lenders, after assigning that responsibility to provinces in 2007. “Budget 2023 announces the government’s intention to adjust the Criminal Code payday lending exemption to require payday lenders to charge no more than $14 per $100 borrowed,” the budget states.

Payday loans are typically charged on a monthly or biweekly basis. A biweekly loan of $100, with a $14 charge, is the equivalent of 365 percent interest, six times the legal limit. Approximately 5 percent of Canadians use payday loans, the Financial Consumer Agency of Canada reported on Feb. 13.

Payday lenders argued, in a June 18, 2022, submission to the federal finance department, that restrictions on their trade would send borrowers considered high risk to unlicensed loan sharks. The Canadian Lenders Association said that roughly 301,000 Canadians, out of 29.7 million with TransUnion Credit Scores, are “considered unscorable.”

The Ontario government conducted a study in 2009 that said payday lenders had an average of 7 percent profit margins, but had loan costs of 22 percent as a result of expenses for storefront operations, and unrecoverable loans at 4 percent.