The Albanese Labor government is commissioning an inquiry into the monopolisation of various Australian sectors amid concerns productivity and economic growth are dwindling.

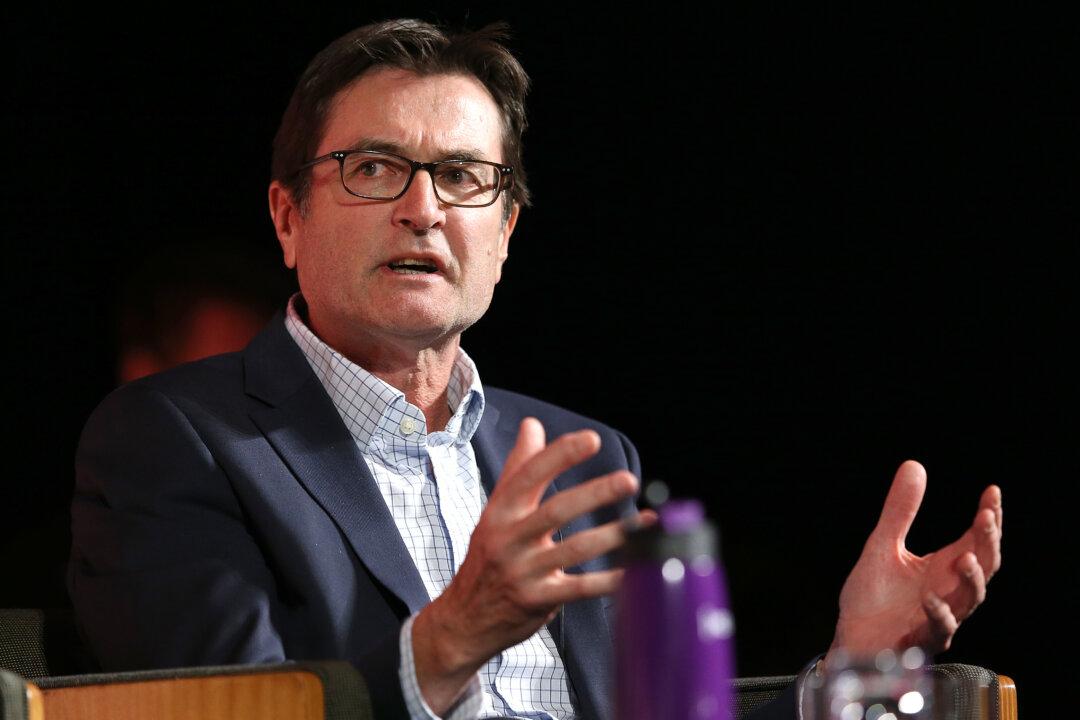

At a joint press conference in Canberra on Aug. 23, Treasurer Jim Chalmers officially announced the inquiry along with Assistant Minister for Competition and Treasury Andrew Leigh.