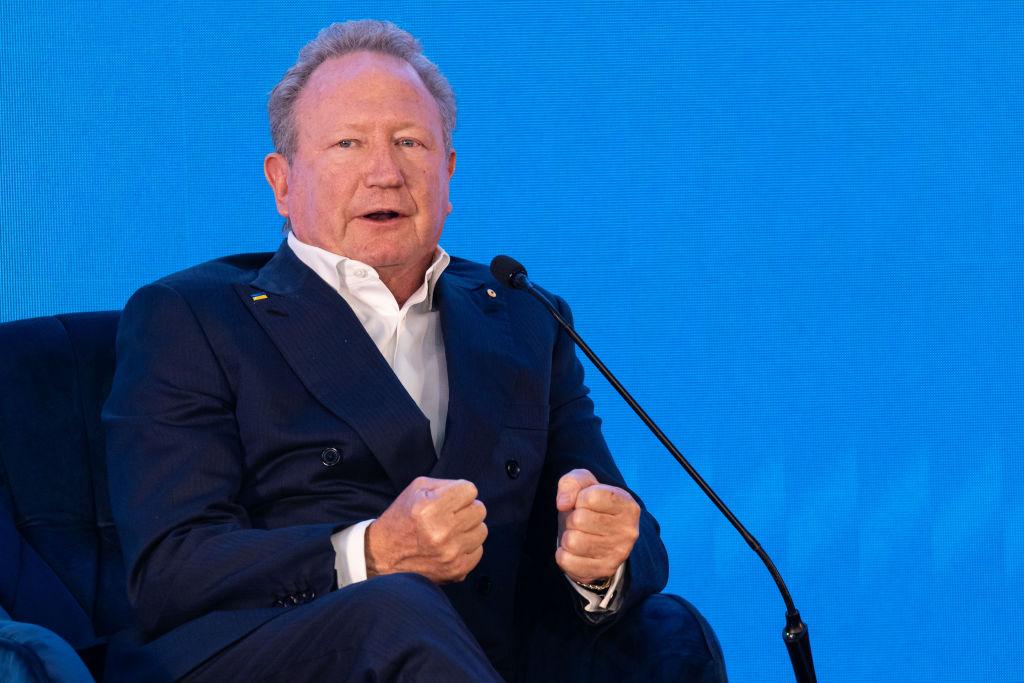

Mining magnate and former CEO of Fortescue Metals, Andrew Forrest, believes an overreliance on fossil fuels is to blame for Australia’s record-high energy prices.

In an interview with 2GB’s radio last week, Forrest declared that to combat high levels of inflation, Australia must swiftly transition to what he believes to be the cheapest form of energy available.