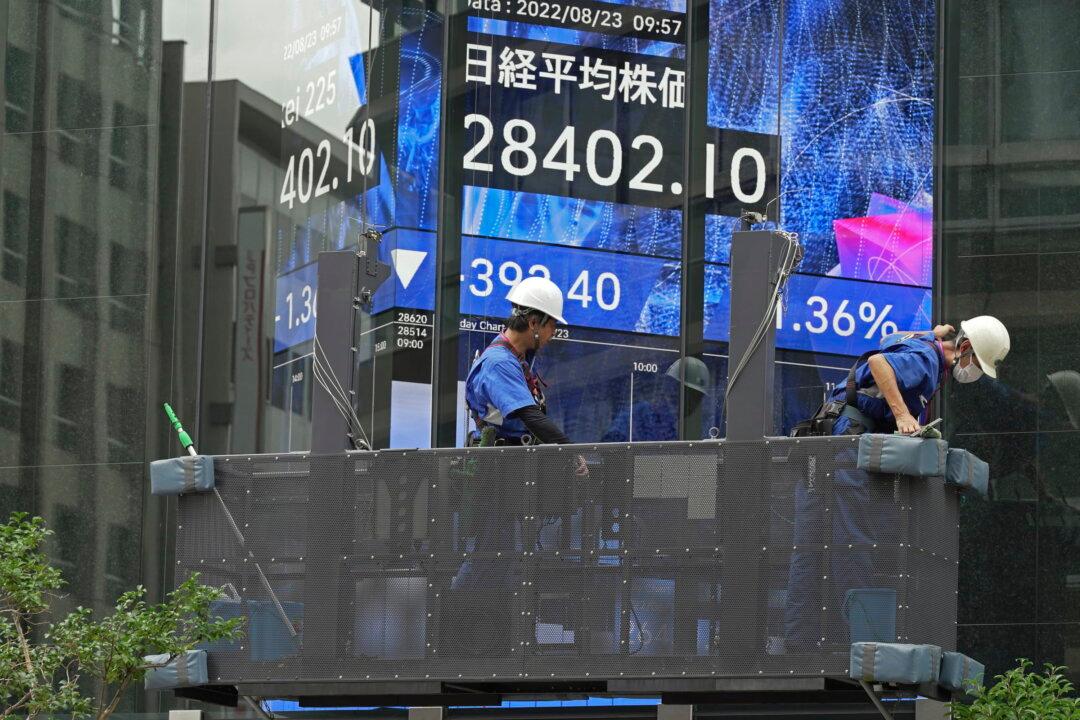

Japan’s core inflation measures jumped to a record high, according to its central bank, the Bank of Japan (BoJ), on Aug. 23, as rising energy costs and a weak yen (owing to U.S. dollar strength) have forced Japanese businesses to pass their costs onto consumers, with several price gauges hitting new highs.

Inflation in Japan exceeded its central bank’s 2 percent target in July, putting Bank of Japan Governor Haruhiko Kuroda’s persistence with ultra-low interest rates under more scrutiny.