The federal government has extended insolvency relief and bank protection beyond the original Sept. 25 deadline for another three months in a bid to avoid an avalanche of business failures amidst the economic recession.

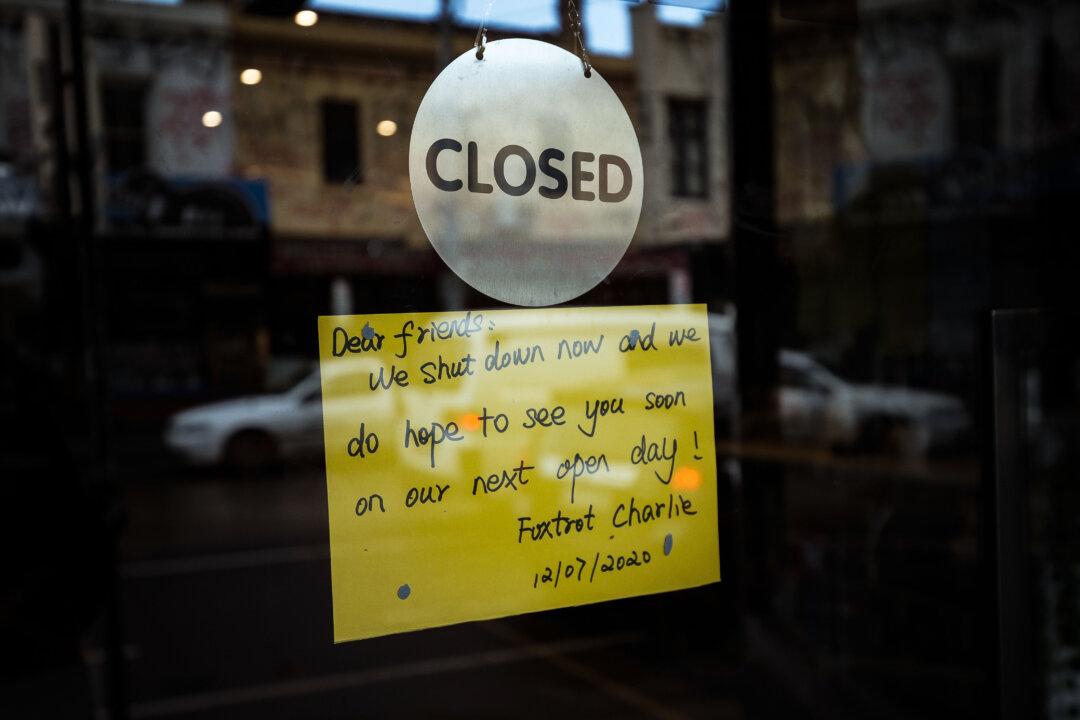

The move, announced on Sept. 7 following Victoria’s decision to extend stage 4 lockdown, coincides with the end of the initial wave of 6-month deferrals for business loan repayments.