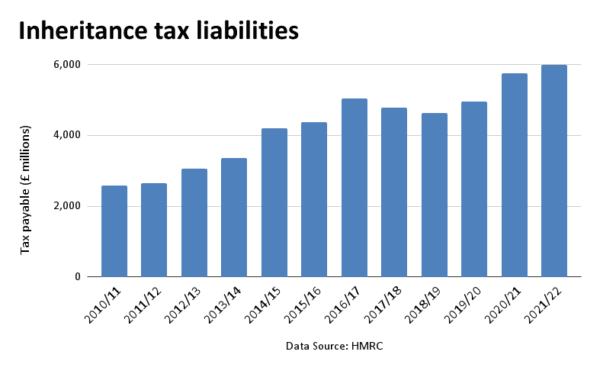

Record-high inheritance tax (IHT) liabilities were driven by COVID-19, asset price inflation, and the government’s tax freeze, according to HM Revenue and Customs (HMRC).

Official data published on Wednesday show 4.39 percent of UK deaths in the year 2021–2022 have resulted in an IHT charge, 0.66 percent up from the previous year.

In the same year, the total amount of IHT payable was £5.99 billion, representing a 4 percent increase from the previous year and a 26 percent jump from a decade ago.

According to HMRC’s analysis, the increase is likely due to a combination of factors, including higher volumes of wealth transfers following recent IHT-liable deaths, which were “caused at least in part by COVID-19,” recent rises in asset values, and the government’s decision to freeze IHT tax free thresholds instead of letting them rise with inflation.

IHT is paid at a rate of 40 percent on the value of estates above a threshold of 325,000 pounds—which has not changed since 2009. There are additional allowances for transferring family homes to younger generations.

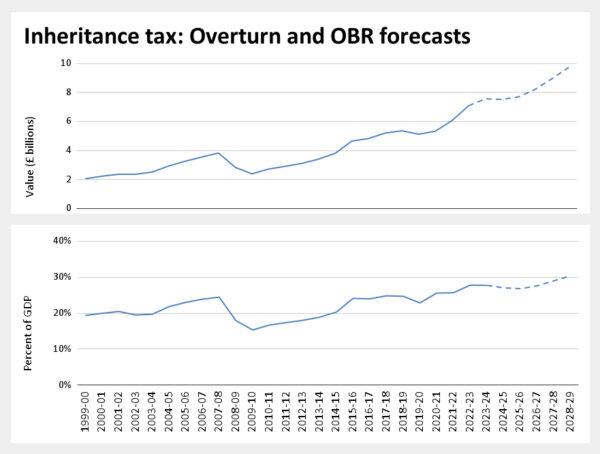

According to figures published in March by the Office for Budget Responsibilities (OBR), IHT paid in the year 2021/2022 was £6.06 billion, but the record has been broken again in the following year, when £7.09 billion was paid.

OBR forecasts show the amount could reach £9.73 billion a year in five years.

The figure is likely to be higher as OBR forecasts were made before the new Labour government announced that changes to the non-domicile tax regime will affect IHT.

The previous government had also signalled its intention to do so when the OBR last published its economic outlook. The OBR said it would include the effects of the change “in due course.”

In a policy paper published on Wednesday, The Treasury said IHT will change from the current domicile-based system to a residence-based system from April 6, 2025, meaning IHT will be chargeable if an individual has been a resident in the UK for 10 years prior to the tax year.

The Institute for Fiscal Studies have estimated that 2.7 billion pounds could be raised by making some IHT allowances—which exempt assets like family businesses, farmland, woodland and pension savings—less generous, but past governments have avoided major reforms to inheritance tax.

However, Chancellor Rachel Reeves repeatedly dodged questions on whether IHT will change, as well as whether pension reform and capital gains tax hikes were on the cards in her autumn budget.

Speaking to Parliament on Monday, Reeves said she has found a £22-billion budge hole after ordering a review of public finance upon Labour’s entry to Downing Street.

The chancellor announced a raft of spending cuts, and said she expects to make “difficult decisions … across spending, welfare and tax” in her first budget on October 30.

Asked about potential tax hikes including IHT and capital gains tax, she said while appearing on the News Agents podcast on Wednesday: “We had in our manifesto a commitment to fiscal rules to balance day-to-day spending through tax receipts, and by the end of the forecast period to get debt down as a share of GDP.

“Those are sensible fiscal rules to keep a grip of the public finances. We also made other commitments in our manifesto, not to increase national insurance, VAT, or income tax for the duration, and we’ll stick with those.”

On Monday, Reeves axes a number of Tories policies that she said is not affordable, including plans to build 40 new hospitals and £1 billion worth of transport projects.