The Liberal government’s fall economic statement acknowledges the cost-of-living crisis weighing on Canadians, but offers few new measures to tackle it while pledging to keep deficits in check.

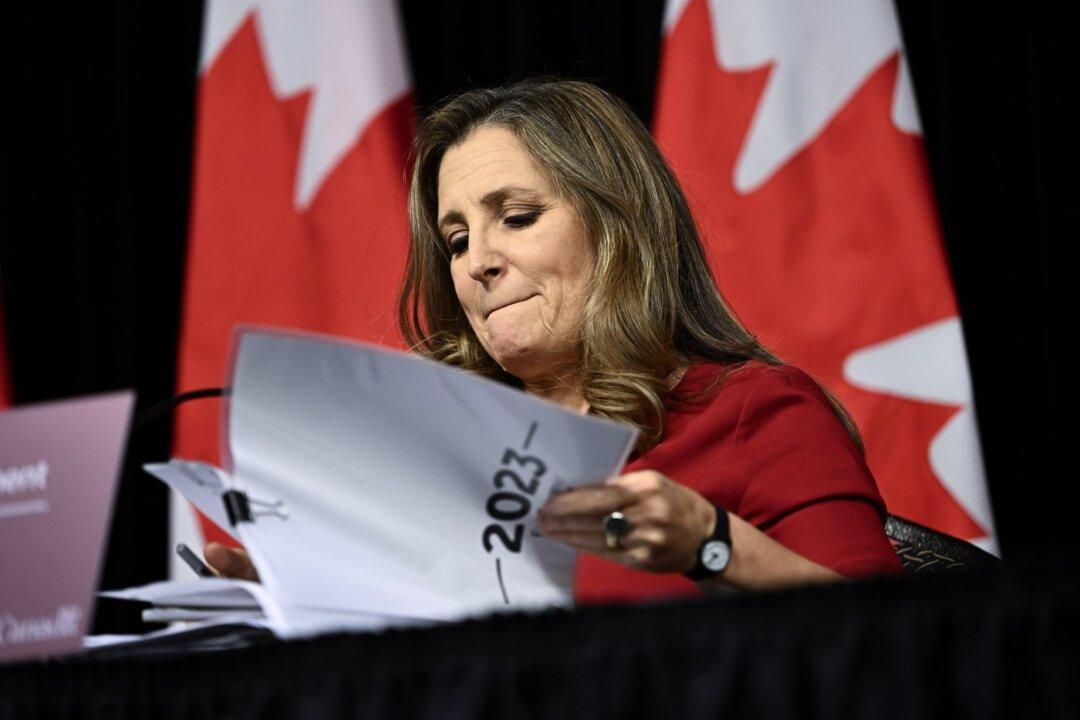

Finance Minister Chrystia Freeland presented her fiscal update in the House of Commons on Nov. 21, stressing the pressure inflation and a slowing economy are putting on federal finances.