The federal budget watchdog says that an upcoming revised analysis on the economic impact of the carbon tax using proper data won’t change the previous conclusion that it leaves Canadians worse off.

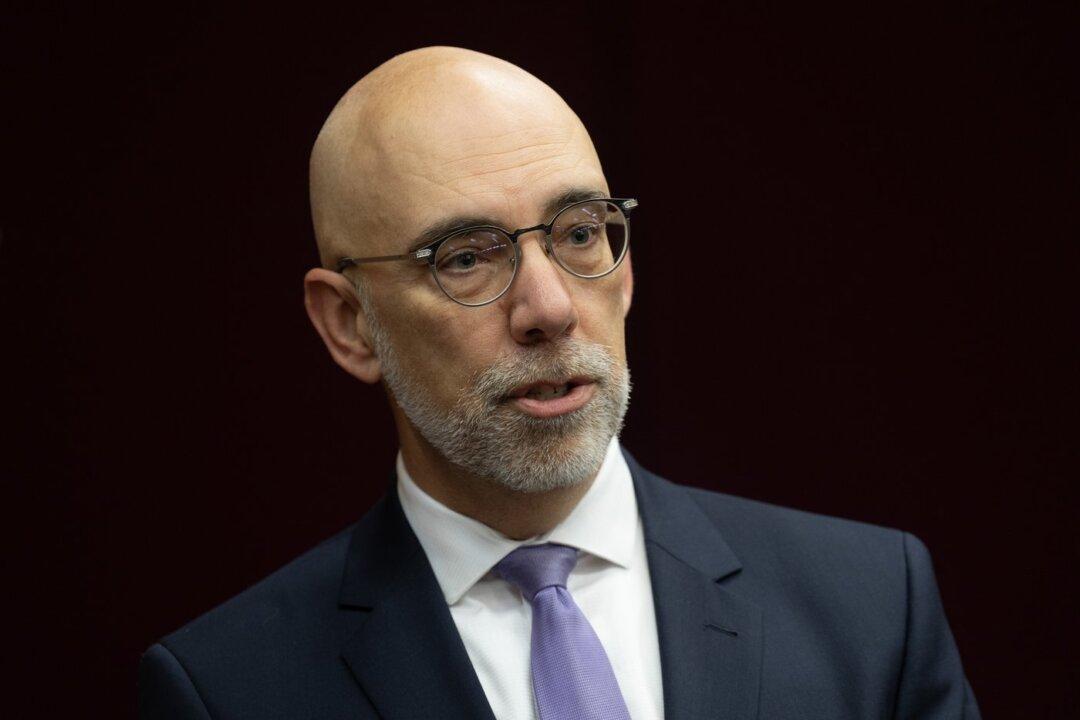

Parliamentary Budget Officer (PBO) Yves Giroux came under fire this week with Liberals highlighting an error that was made in his previous analyses on the fuel charge, or carbon tax.