SANTA CRUZ, Bolivia—Argentina’s socialist government is scrambling to stem its hemorrhaging currency rates, economic recession, and hyperinflation while it continues its negotiations with China over swaps and debt relief.

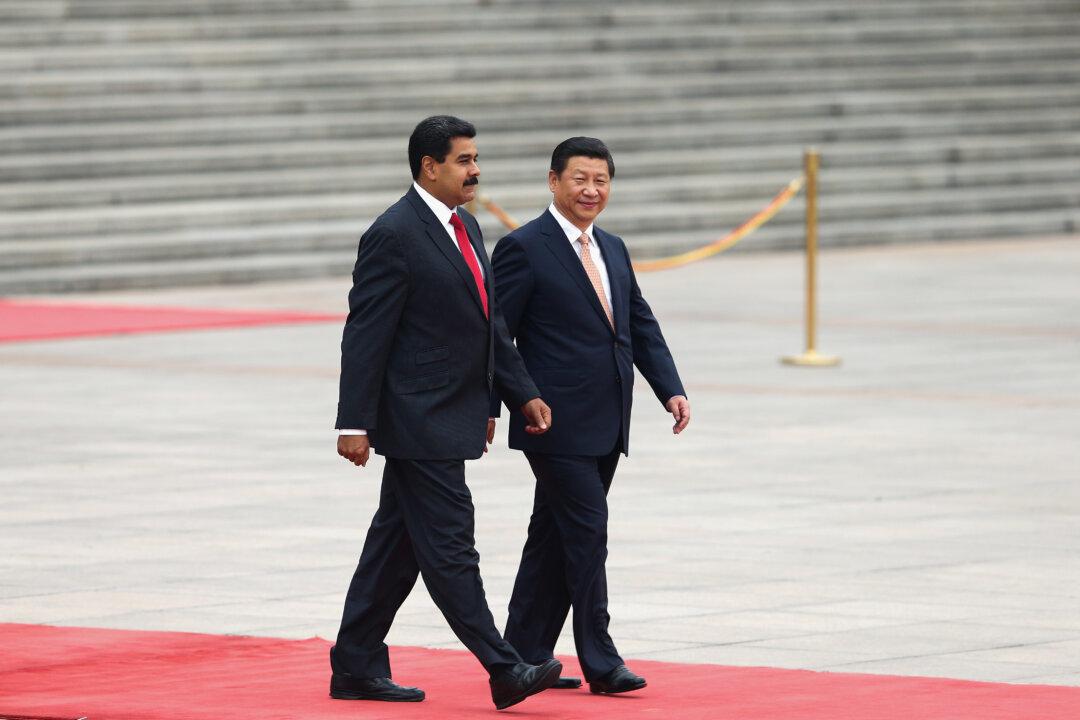

Argentina had an established track record of defaulting on loans even before the regime in China agreed to grant an additional $19 million to the Argentine government in 2020. China and Latin America relations analyst Fernando Menéndez told The Epoch Times that while Beijing’s loans in the region may look risky from a traditional standpoint, they still come out on top in the end.