The chancellor has announced plans for a new National Wealth Fund designed to attract billions of pounds in private sector investment in industries such as green steel and decarbonisation.

The new Labour government’s flagship project has access to £7.3 billion in additional state funding to support the investment plan.

Chancellor Rachel Reeves and Business Secretary Jonathan Reynolds said on Wednesday they have instructed officials to begin work to align the UK Infrastructure Bank and the British Business Bank under a new National Wealth Fund.

National Wealth Fund Taskforce

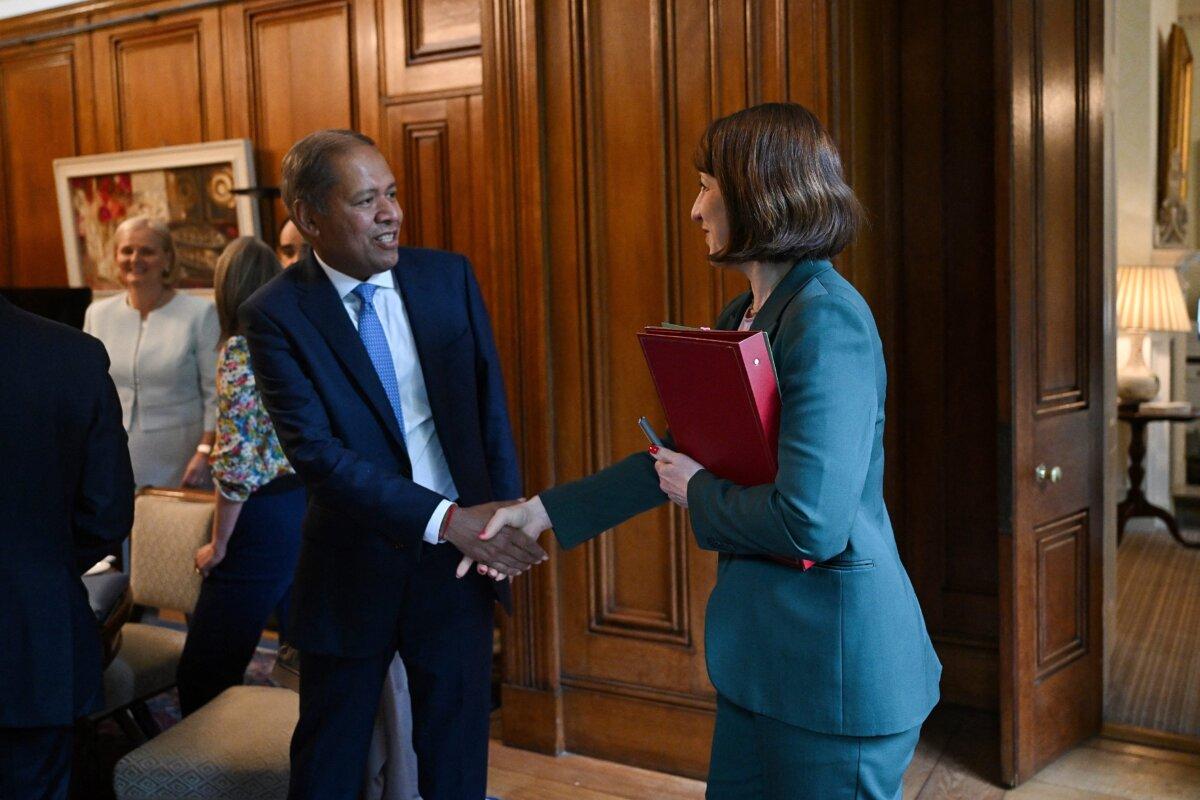

Ms. Reeves met with a nine-person National Wealth Fund Taskforce at Number 11 Downing Street in order to launch the plans.She said that the government will initially focus investment on five industries: green steel, green hydrogen, industrial decarbonisation, gigafactories, and ports.

‘Taking Scarce Amounts of Public Money’

Mr. Carney said that “this new government has rightly identified infrastructure investment as a core enabler of building high value, low carbon, competitive industries.”A report he authored on the subject inspired Labour’s plans.

“The smart use of public investment via the national wealth fund can kick-start economic growth and crowd in private capital to vital sectors including ports, heavy industry and manufacturing.”

Mr. Carney said, “What the report is doing is taking scarce amounts of public money and making sure they have the maximum impact in order to achieve the objectives of the country.”

He added: “They’re new types of battery factories for the auto sector. They’re taking carbon out of the atmosphere when we’re producing steel in the UK.

“So it takes money that exists today—a scarce amount of public money—it multiplies it many times over and then gets it to work very quickly.

“That’s the goal of the report, and I would say that all of us who helped prepare it, very much myself included, are really pleased how quickly the government is moving on it.”

Regional Prosperity and Bitcoin

In 2023, the Institute for Public Policy Research (IPPR) said that a national investment fund would become “an essential instrument for a green industrial strategy targeted on delivering energy security, a technologically competitive zero-carbon economy and regional prosperity.”It said that the economy needs the fund to do something about the “vicious circle between de-industrialisation and low levels of investments” which has translated into greater regional disparities.

The UK’s bitcoin community welcomed the news.

Freddie New, head of policy at Bitcoin Policy UK, told The Epoch Times by email that “bitcoin represents an asymmetric opportunity for Labour’s Wealth Fund.”

“Simply by changing the way in which the UK treats bitcoin for tax and regulatory purposes, and providing the right environment for miners to support and complement our electricity grid as it becomes increasingly sustainable, this government can undo many of the mistakes of the previous government that have driven the industry offshore,” he added.

However former World Bank economist Professor Gordon Hughes told The Epoch Times that he didn’t believe it was a genuine wealth fund.

He said that large wealth funds traditionally take a proportion of revenues earned by the fund, primarily from oil, but in some cases, minerals and other natural resources. These are then invested in things that will produce a return in the longer run.

He said that this is not “the objective of the Labour government.”

“They are simply channelling subsidies for things that they regard as desirable through a vehicle that they call the National Wealth Fund,” he said.

“It’s nothing more than the form of industrial subsidies, in this case, for green activities,” he said. Mr Hughes said that many of the industries are “hopelessly uneconomic.”

‘Politicised’

Financial journalist Dominic Frisby told The Epoch Times by email: “If it follows the Norwegian model then great. But it won’t.”Norway’s wealth fund, which was was created in 1990 to manage the surplus oil wealth revenues for future generations, is today worth £1 trillion, or around £185,000 for every Norwegian.

“It will be politicised, ideology will take precedence over proper business models, rent-seekers and crony capitalists will stuff their mouths with gold, and it will end up needing bailing out,” added Mr. Frisby.

A Treasury spokesman told The Epoch Times by email, “The National Wealth Fund will create a step change in our ability to mobilise private capital in the UK’s most important sectors and assets, supporting thousands of jobs across the country while generating a return for the taxpayer.”