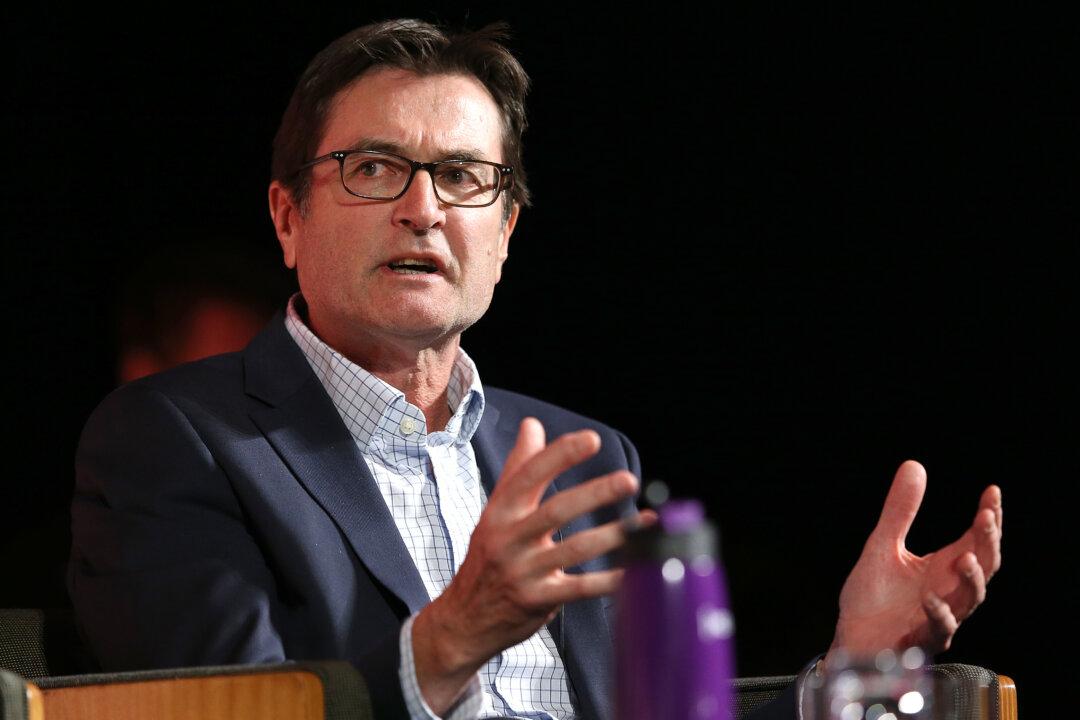

The spokesperson for advocacy group Cash Welcome, Jason Bryce, has warned Australians about the imminence of a cashless society, saying the erosion of physical currencies will undermine the freedoms of everyday individuals.

“Banks sit at the heart of our economic system and are now herding us into their privately owned cashless transaction systems that are unreliable,” Mr. Bryce told the Epoch Times.