The annual inflation rate rose to 3.4 percent in December, up from 3.1 percent in November, according to Statistics Canada.

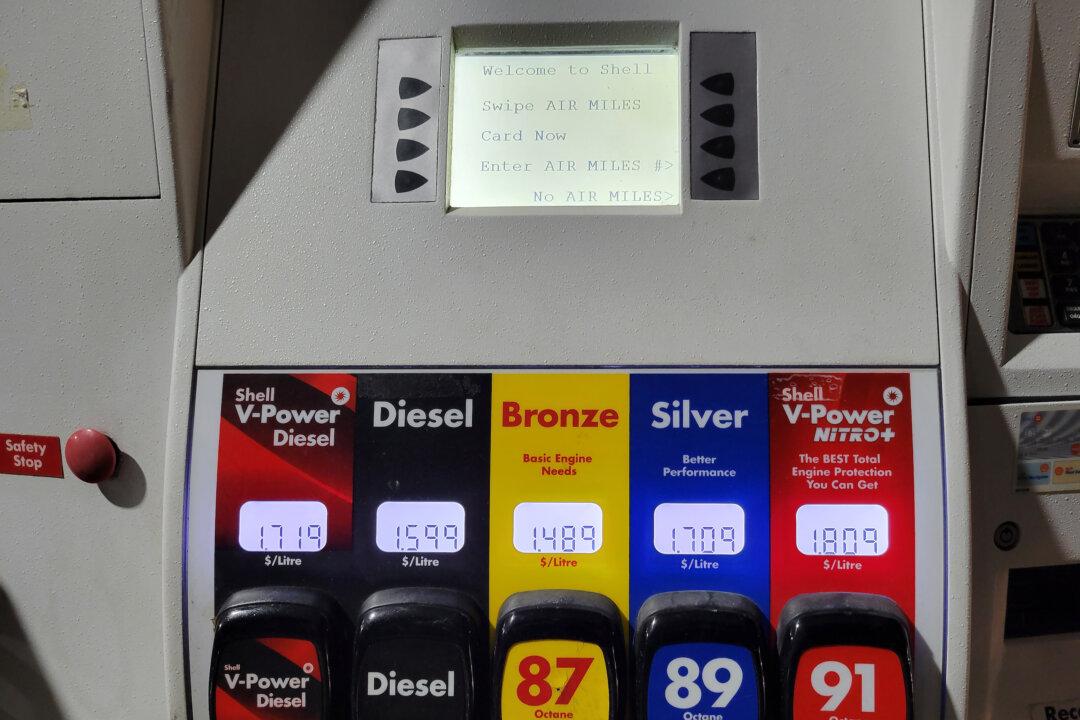

The increase was a reflection of higher gasoline prices compared with a year ago, the federal agency said in its consumer price index (CPI) report released Jan. 16. The price of gas increased 1.4 percent year-over-year in December, despite being on the decline during the previous four months. The price of air travel, passenger vehicles, and rent also contributed to the uptick in the inflation rate.