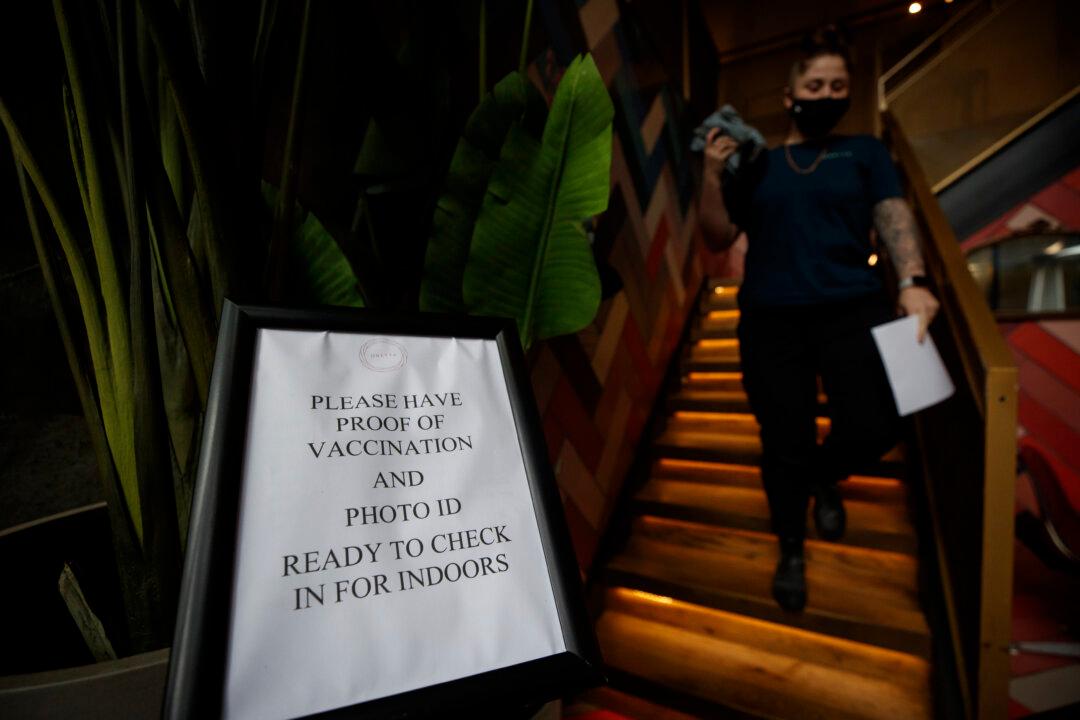

Businesses implementing Ontario’s COVID-19 vaccine certificate requirements are seeing decreased sales, according to a survey conducted by the Canadian Federation of Independent Business (CFIB).

Over 60 percent of businesses requiring patrons to show COVID-19 vaccine passports are reporting lower sales “as a direct result” of the provincial government’s vaccination mandates, said Dan Kelly, president and chief executive officer of the CFIB.