The federal government can afford to increase spending or cut taxes by 1.5 percent of gross domestic product (GDP) annually for the next 74 years and still maintain fiscal sustainability, according to a report from the Parliamentary Budget Officer (PBO).

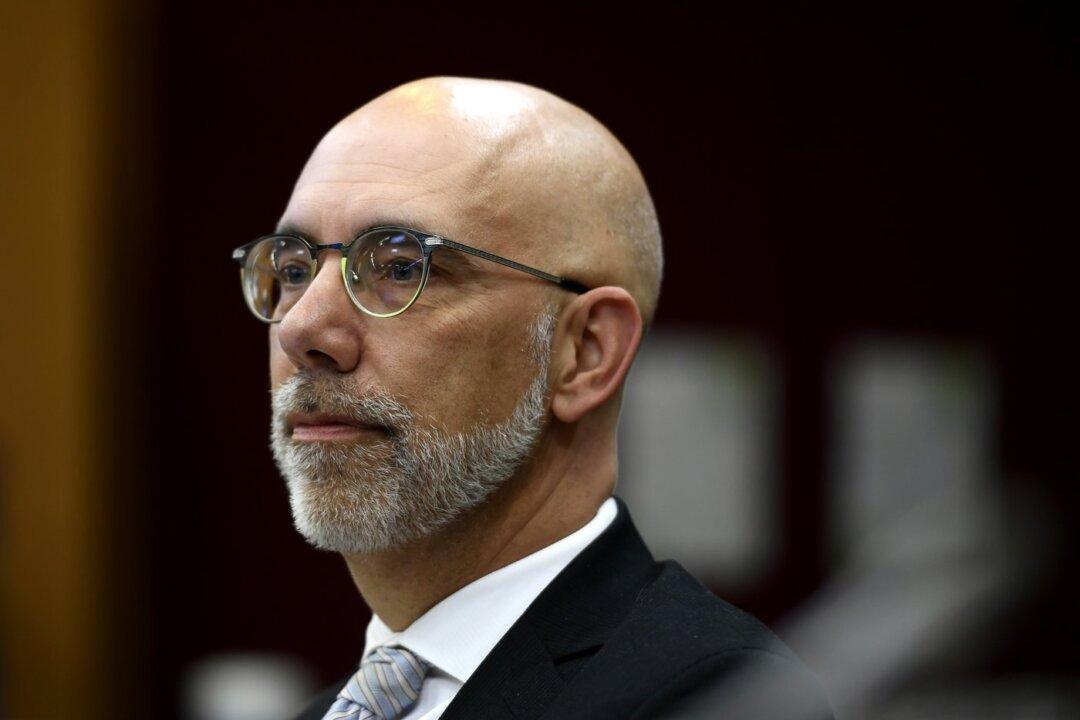

In current dollars, that would mean Ottawa could increase or decrease spending by $46 billion while also stabilizing the net debt over the long term, PBO Yves Giroux said in his 2024 fiscal sustainability report.