The federal budget watchdog says Ottawa is withholding its analysis of the economic impacts of the carbon tax.

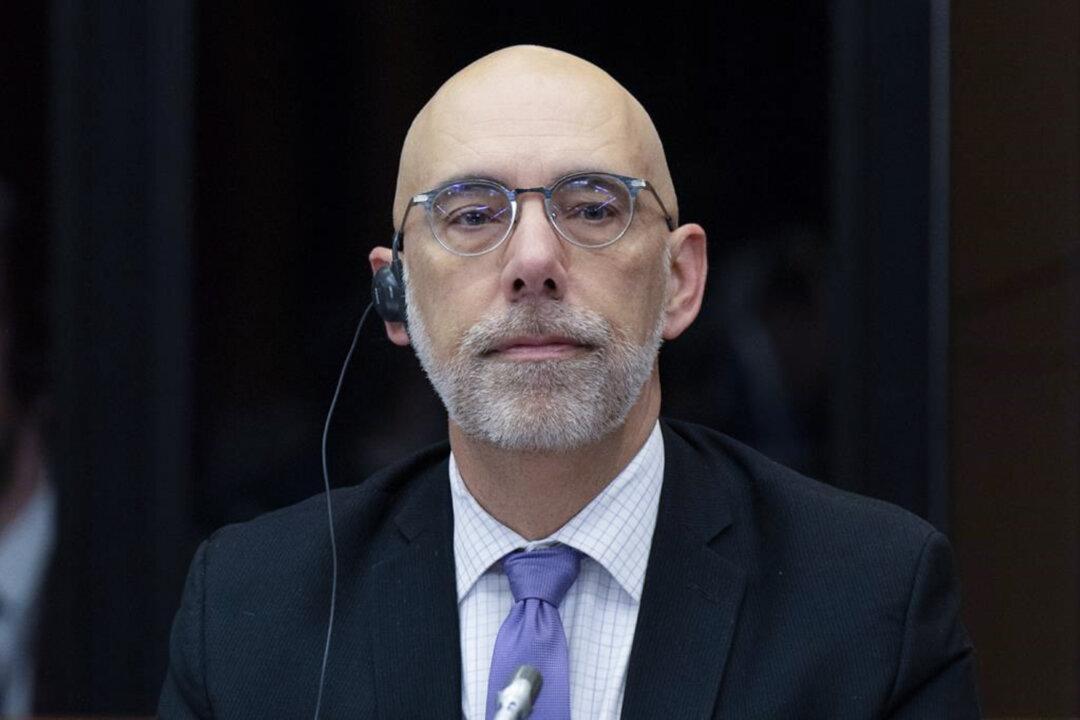

“We’ve seen that, staff in my office, but we’ve been told explicitly not to disclose it and reference it,” Parliamentary Budget Officer (PBO) Yves Giroux told the House of Commons finance committee June 3.