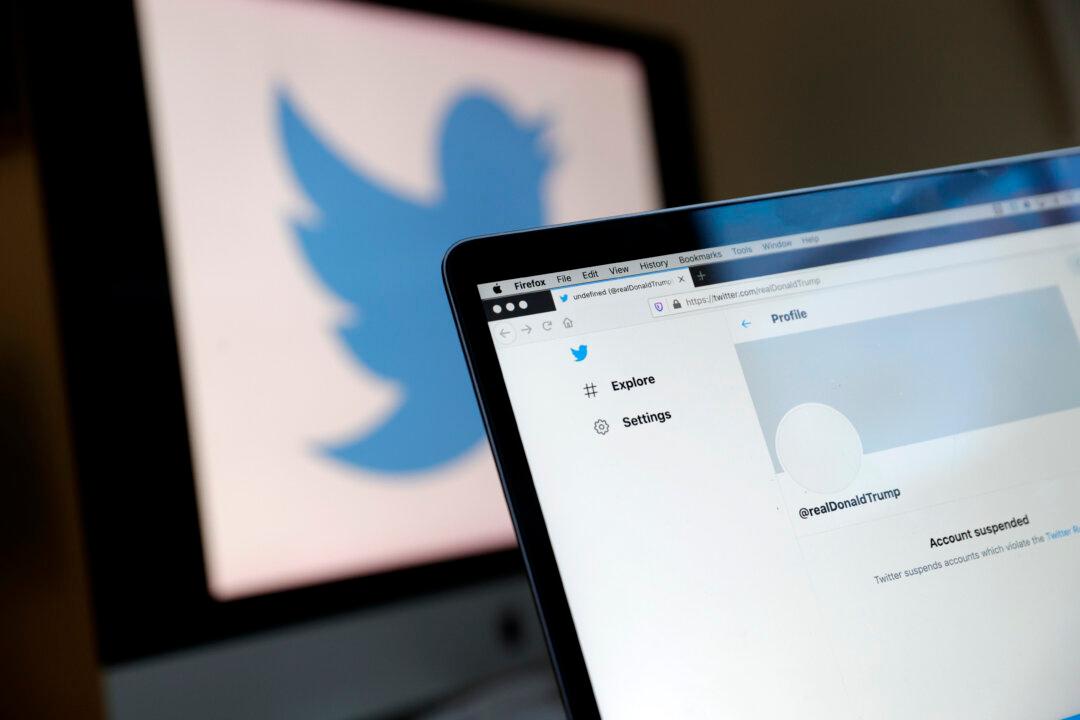

Twitter users are voting with their feet in response to the tech giant’s ban on U.S. President Trump’s account, which could usher in the end of the “free speech wing of the free-speech party,” according to one federal member of Parliament.

One expert meanwhile, says Twitter’s decision was a commercial one, with the tech giant weighing up the potential backlash from different audiences.