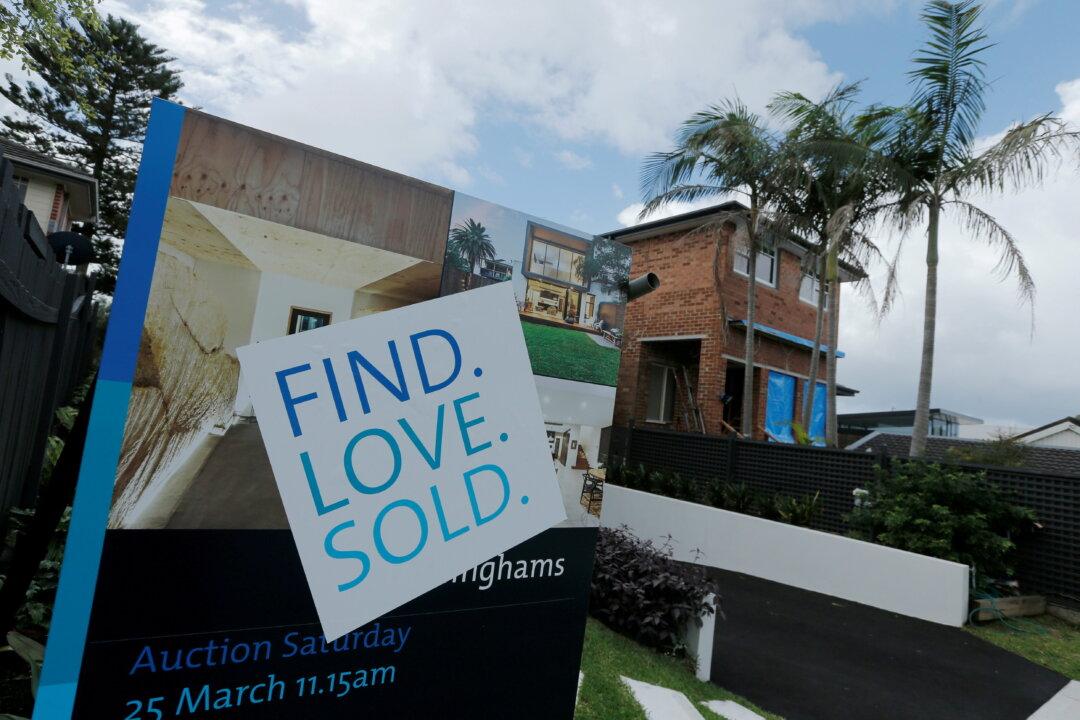

Successive Australian governments at the federal and state level have placed too much emphasis on stimulus measures to help first-home buyers enter the property market, according to a new report.

The Australian Housing and Urban Research Institute’s study said housing policy for the last two decades had focused too much on “demand-side” levers while doing very little to increase supply.