The price of oil is once again grabbing headlines, with its watchers and markets consistently indicating that more of the commodity is needed now, regardless of the green transition that governments envision.

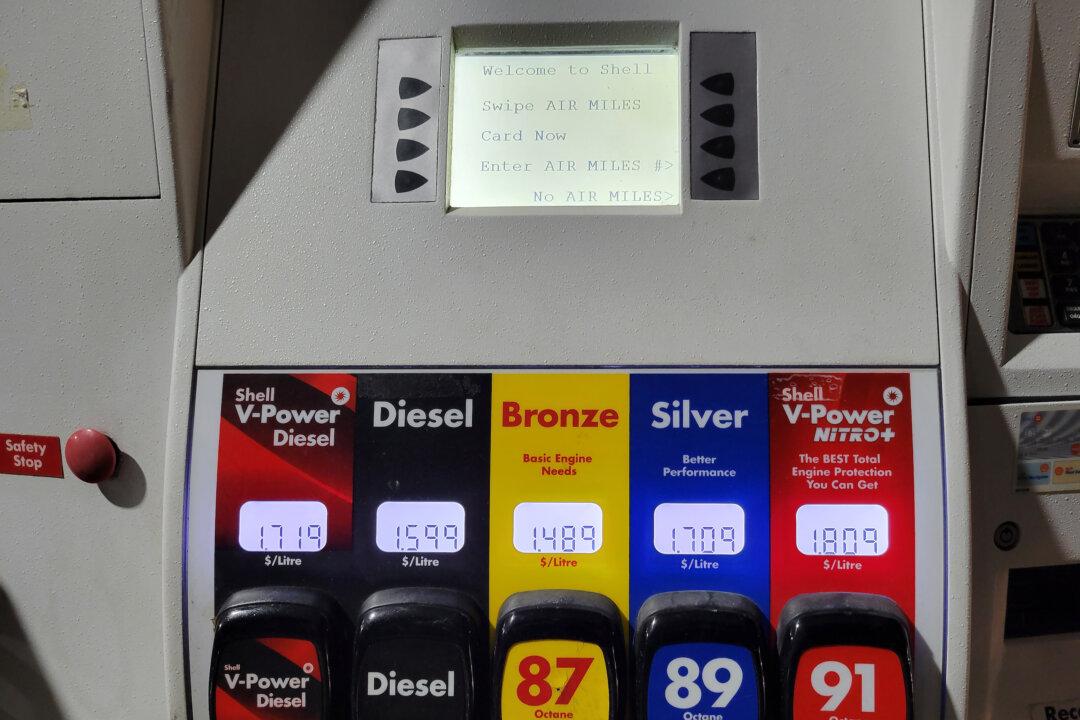

The price of West Texas Intermediate (WTI)—the U.S. crude oil benchmark—hit a seven-year high on Feb. 4 when it topped US$92 a barrel. That same day Bloomberg reported that gas prices across Canada broke an all-time record with a national average retail fuel price of $1.516 per litre, based on data from fuel-price tracking site gasbuddy.com, which has data going back as far as 2008.

But Dan McTeague, president of Canadians for Affordable Energy and a former Liberal MP, told The Epoch Times that the problem is more fundamental in nature and that prices were already moving higher before Russia renewed aggression against Ukraine or any cold weather spells hit.

“It’s very much a product of undersupply, mostly driven by under-investment or deliberate strangulation of capex [capital expenditures] needed to produce [oil and gas],” he said.

McTeague said Ontario gas prices are heading for $1.75 a litre—that’s 10 cents higher than what he predicted in December for what the price would be sometime between the end of February and early May.

“What this really means is that people have got to start to … get a grip, and get real, because you can’t do without fossil fuels.”

And this applies to making electric vehicles (EVs) as well, McTeague points out.

The growth of EVs is ramping up given high gas prices and continuing government efforts to build out charging infrastructure.

But energy analysts Jackie Forrest and Peter Tertzakian said on their Feb. 1 ARC Energy Institute podcast that the demand for internal combustion engines is not exactly dropping and that the growth of EVs has a while to go before it makes a dent on the user base of combustion engines.

“You’re looking at the wrong metric, say growth in electric vehicles. You should be looking at the retirement of combustion engine vehicles being taken out of the fleet,” Tertzakian said. He added that the number of retirements is actually going down, not up.

He offered his forecast of when oil demand might subside.

“It’s going to be a long time before the oil demand curve rolls over—like I think optimistically will be around 2030.”

Markets Know What They Like

Stock markets have also clearly signalled where they think future returns are coming from. Over the past year, traditional energy stocks have significantly outperformed the market, completely obliterating green energy stocks, which are lagging badly.

Some of the S&P 500’s top gainers in the past year were oil stocks, like Devon Energy up over 160 percent, Marathon Oil up over 130 percent, ConocoPhillips up nearly 100 percent, EOG Resources up over 85 percent, and Occidental Petroleum up almost 60 percent. Two of the biggest names Exxon Mobil and Chevron are up about 55 percent and 50 percent respectively.