EDMONTON—Alberta is adjusting its rules on oil production limits to give companies incentive to drill more conventional wells.

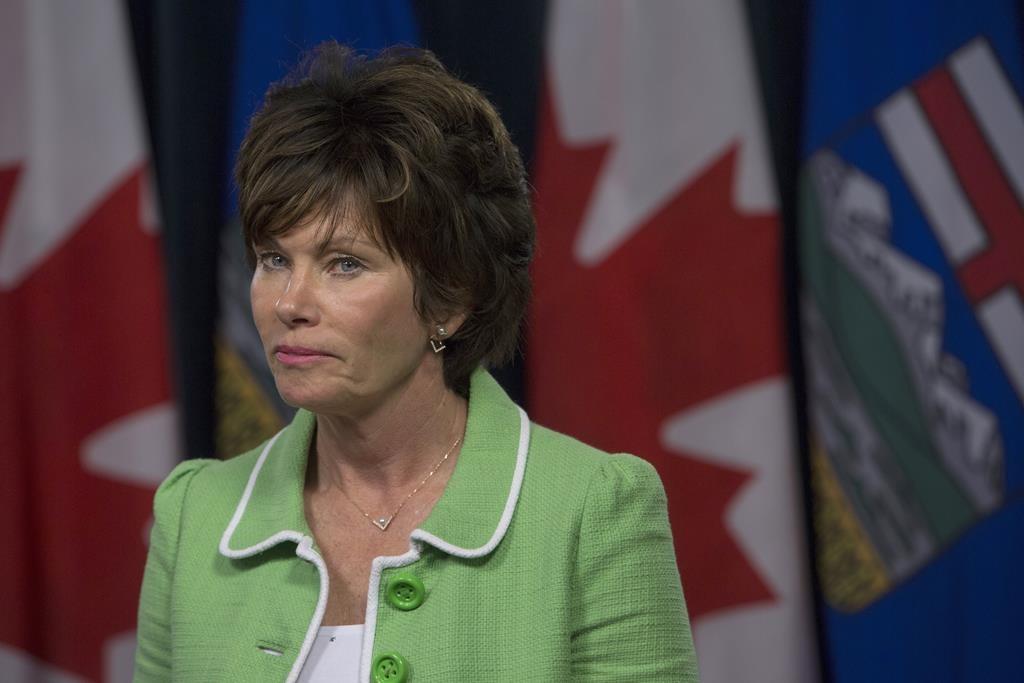

Energy Minister Sonya Savage says that starting immediately any oil produced from a new well will not be subject to the limits.

The province expects the change will spur producers to drill hundreds of new wells and that each well will create about 145 jobs.

“While we want an orderly exit out of curtailment altogether, our communities and drilling sector cannot wait,” Savage told a legislature news conference on Nov. 8.

“That is why we’re taking this action today to encourage investment and bring back jobs.”

In September, Alberta produced 480,000 barrels a day of conventional oil. About one−fifth of that was from operators working under the curtailment rules.

There are exemptions in place so that small producers are not affected by the limits.

The move is the latest action by the government to try to increase investment and employment in Alberta’s oil and gas industry and reverse years of declines in drilling.

Due to pipeline bottlenecks, the former NDP government limited the amount companies could produce to prevent a surplus such as the one last year that sharply reduced prices for Alberta oil.

The United Conservative government has since extended the limit by a year to the end of 2020.

But Savage the expectation is that by the time extra oil from the new wells is ready for shipping, there will be more pipeline capacity, such as Enbridge’s retrofitted Line 3 to the U.S. Midwest, and more rail cars. That should avoid another surplus that would hurt prices for Alberta oil, she said.

“We wouldn’t be doing this if we were not confident that this [change] could handle it,” said Savage.

Last week, the province announced it was easing production limits for companies shipping any extra crude by rail.

Premier Jason Kenney’s government is trying to offload $3.7−billion in contracts signed with rail companies by the previous NDP government to buy and ship more oil by rail to ease the bottleneck.

The province has said that deal was a money−loser for taxpayers.

Asked about when the rail contracts may be offloaded, Savage said: “We’re getting very close. We’re anxious to get those contracts finalized, but at this point we’re still in some complex negotiations [and] very competitive bids.

“[There is] a lot of interest in taking those contracts.”

The Canadian Association of Oilwell Drilling Contractors said the drilling incentive, added to expanded production limits tied to rail, will help.

“2019 was another difficult year, and our activity levels were moving toward the historical lows of 2016,” association president Mark Scholz said in a news release.

“These efforts by the provincial government should encourage new production, and help get women and men in our industry back to work.”

The association said this year’s revised well count is 4,896, well short of the original forecast of 6,962.

It says lower operating costs, the exchange rate and year−round drilling have made the United States a more attractive option for Canadian drillers.