The Ukrainian crisis is widely expected to have a modest negative impact on multinationals with exposure to the eastern European country. An analyst at Wedbush, meanwhile, sees the cybersecurity sector as a potential beneficiary of the adversity.

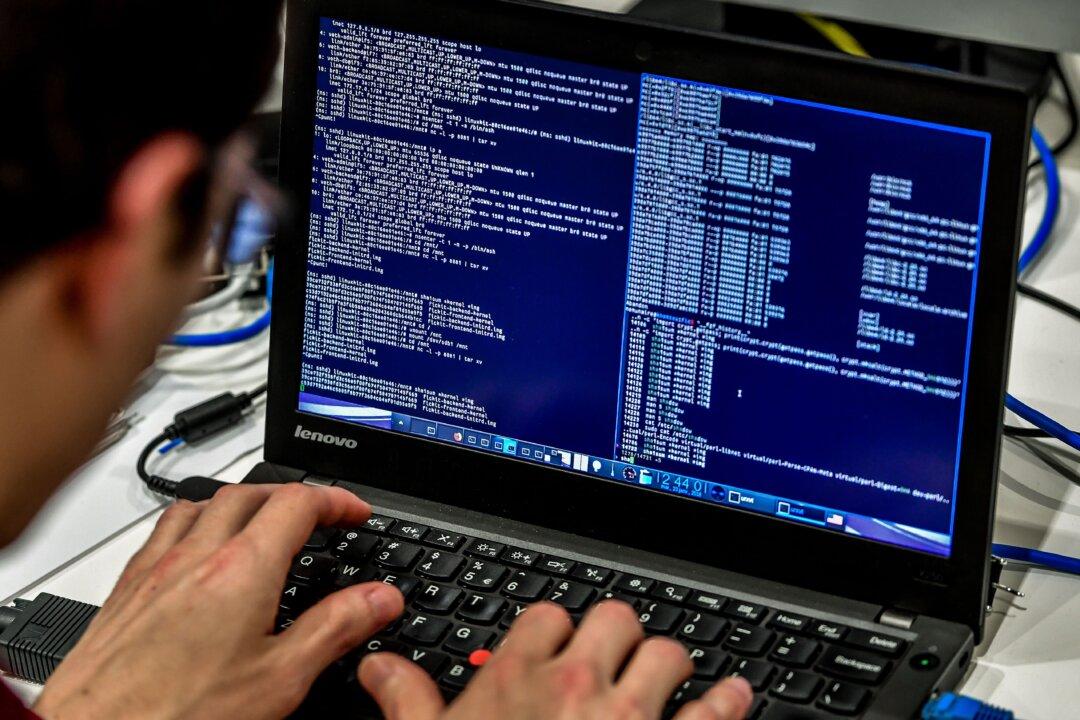

Brace for More Cyberattacks

Russian state-sponsored organizations could step up cybersecurity attacks on U.S. and European governments and enterprises over the coming months, analyst Daniel Ives said in a note.This has added growth tailwinds for the cybersecurity sector, the analyst said. Well-positioned vendors should therefore be a focus sector for tech investors during the current market turmoil, he added.