Commentary

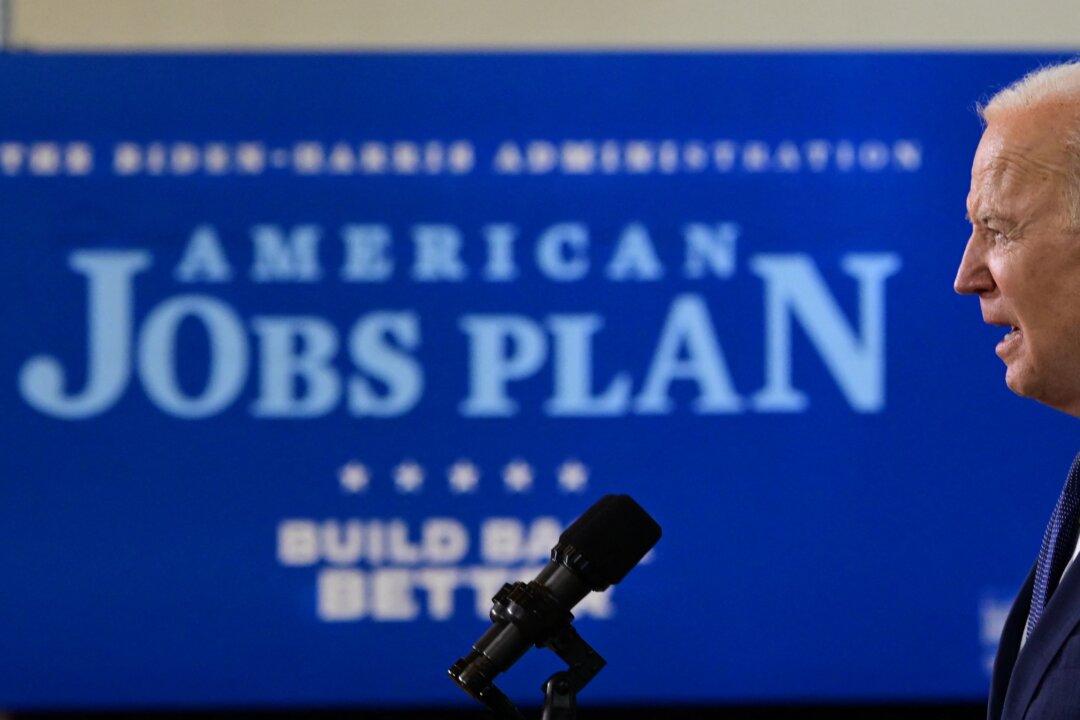

President Joe Biden has announced the American Jobs Plan, which is summed up in the headlines as a $2 trillion investment program in infrastructure and green energy that’s expected to boost job creation, strengthen the manufacturing sector, and drive innovation.