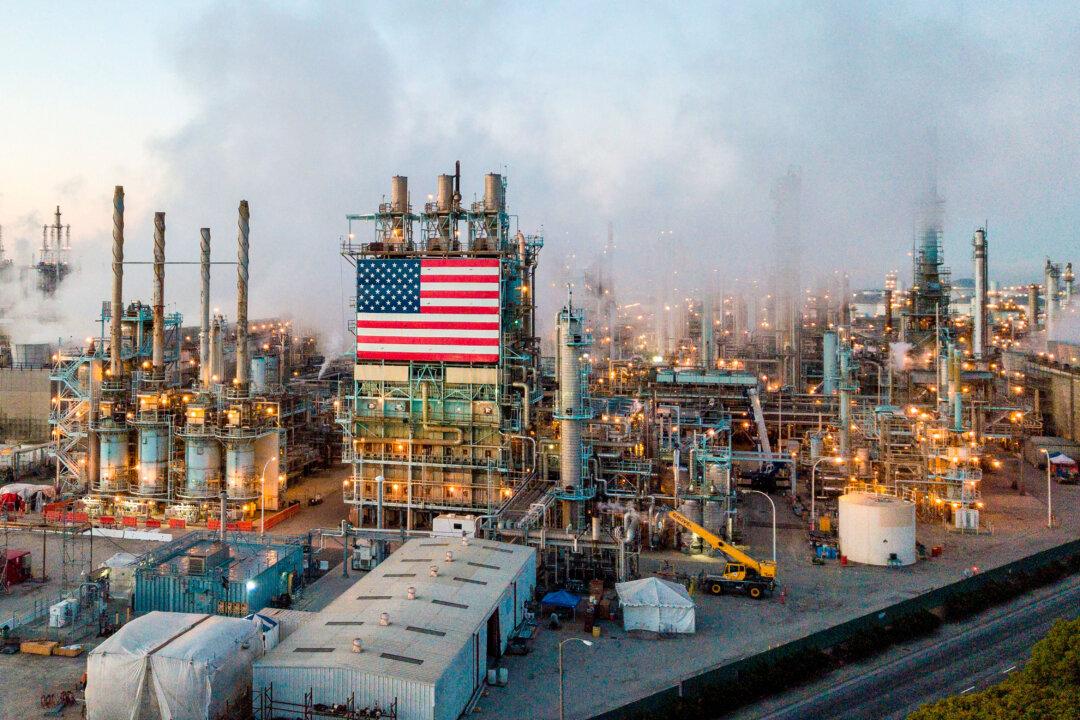

The United States and the rest of the world face a conundrum.

Crude oil prices are above $100 for the first time in nearly eight years amid tight market conditions and Russia’s invasion of Ukraine.

The United States and the rest of the world face a conundrum.

Crude oil prices are above $100 for the first time in nearly eight years amid tight market conditions and Russia’s invasion of Ukraine.