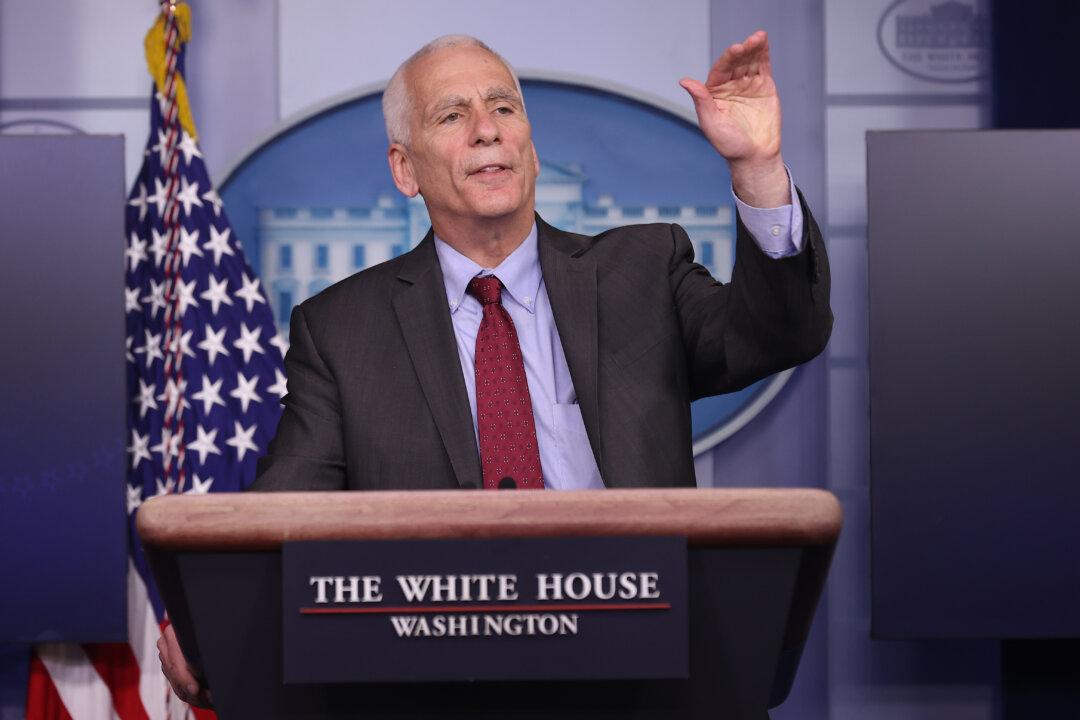

White House economic adviser Jared Bernstein has admitted that inflation in the United States is “unacceptably high” but said he does not see the country heading toward a recession.

Bernstein told “Fox News Sunday” on July 17 that factors such as Russia’s invasion of Ukraine and the current energy crisis are behind surging prices but noted that gas prices, while still too high, are “moving in the right direction,” which he said is “giving Americans some much-needed breathing room.”