The U.S. House of Representatives passed bipartisan legislation to suspend the nation’s debt limit through Jan. 1, 2025, despite vocal opposition on both sides of the aisle.

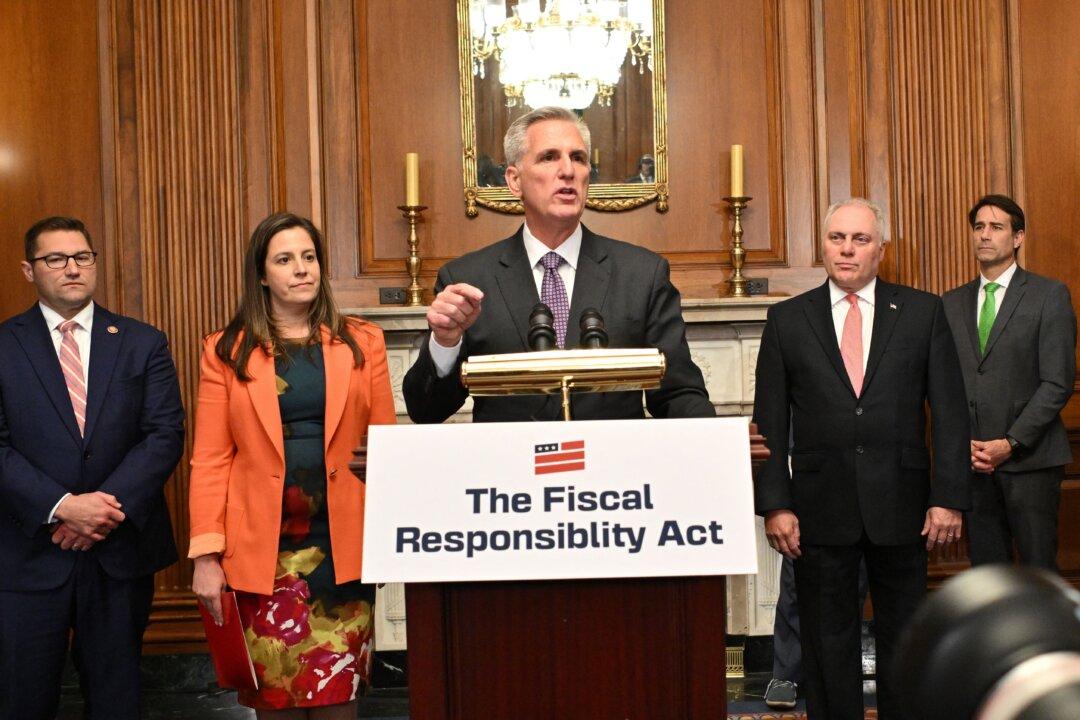

The Fiscal Responsibility Act, a fiscal package put together by President Joe Biden, House Speaker Kevin McCarthy (R-Calif.), and their teams of negotiators, overwhelmingly cleared the lower chamber with a 314–117 vote.