A number of Wells Fargo online customers on Friday reported not seeing paychecks and direct deposits in their accounts, which the bank blamed on a technical issue.

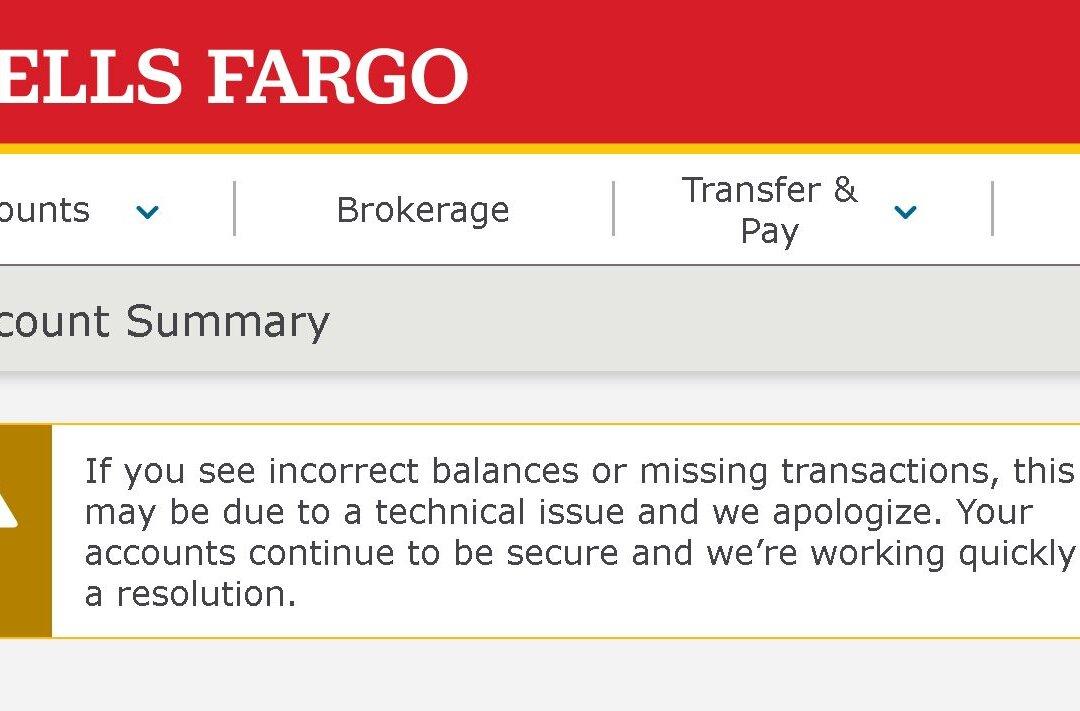

“If you see incorrect balances or missing transactions, this may be due to a technical issue and we apologize,” Wells Fargo told customers in an alert on its website. “Your accounts continue to be secure and we’re working quickly on a resolution.”