According to a new report by the Australian Competition and Consumer Commission (ACCC), gas supplies on Australia’s east coast and southern states are under threat.

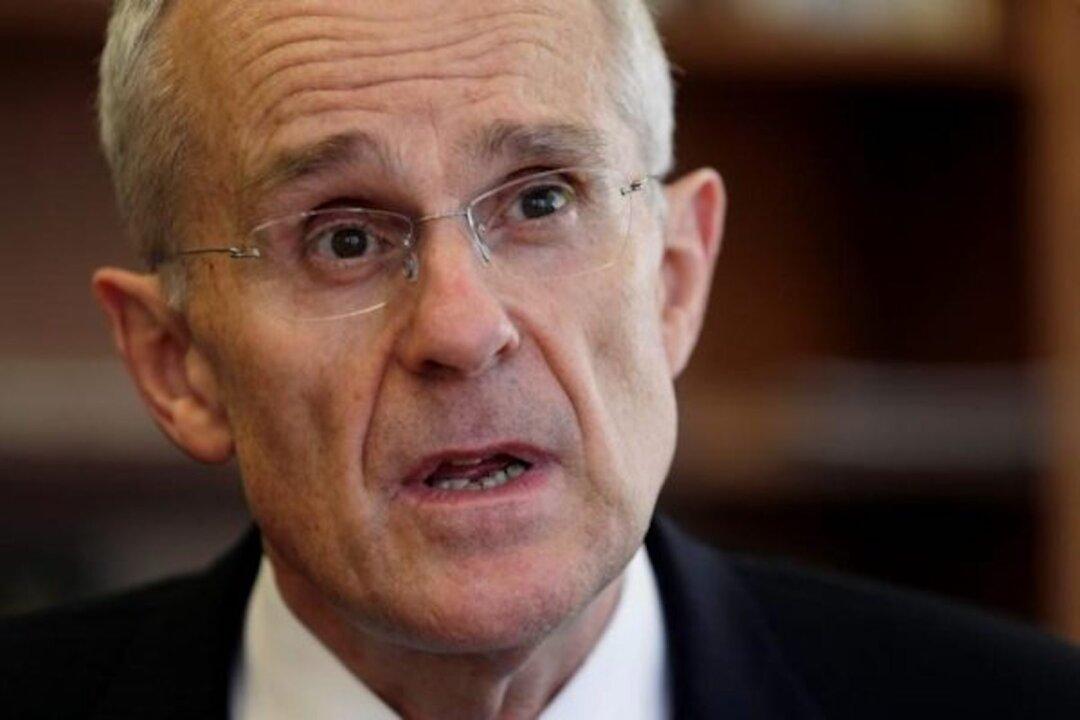

During a conference on March 24, ACCC chair Rod Sims brought to attention a looming gas crisis—which may affect close to 90 percent of Australians—and pointed out we are running out of time to deal with the impending problem.