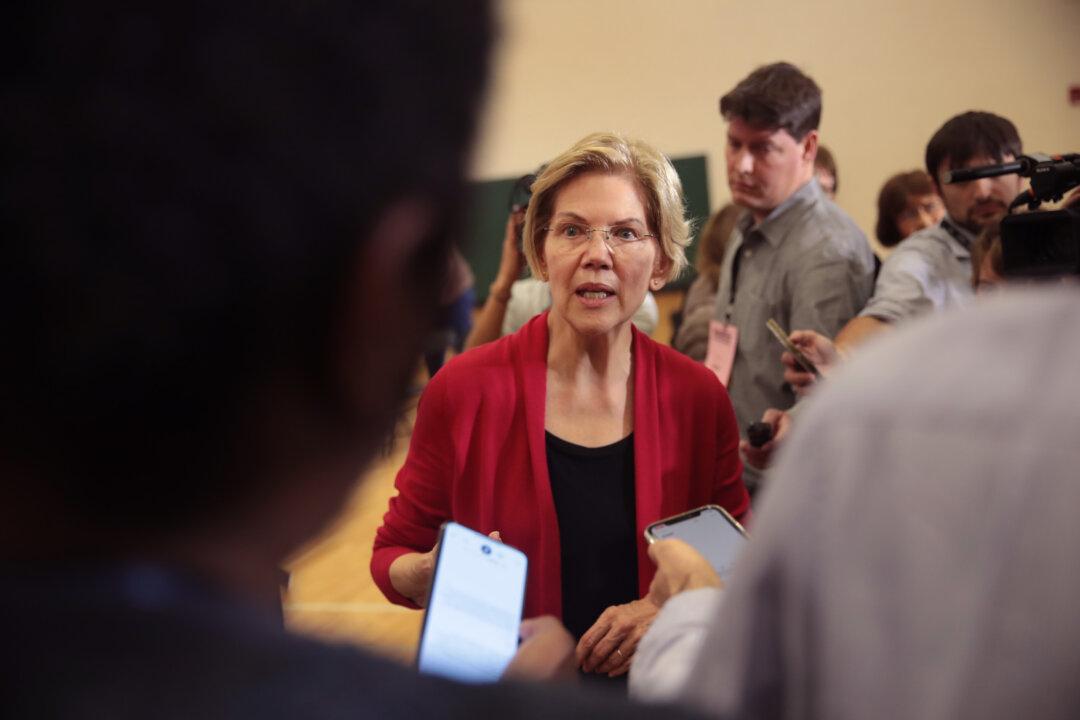

Sen. Elizabeth Warren (D-Mass.) is facing fresh criticism over her recently unveiled Medicare for All plan after claiming that only billionaires will pay increased taxes even though multiple new taxes in the plan itself appear to include those with less money.

Warren’s $52 trillion plan includes some $20 trillion in new taxes, including a harsh wealth tax, taxes on some business owners, and a new tax on financial transactions.